DOW, S&P CLOSE LOWER IN BIGGEST REVERSAL SINCE OCT. 08

U.S. stocks closed lower, after a failed attempt to rally from the Dow's worst 3-day point decline in history, as investor confidence waned amid continued concerns about China and global growth. ( Tweet This )

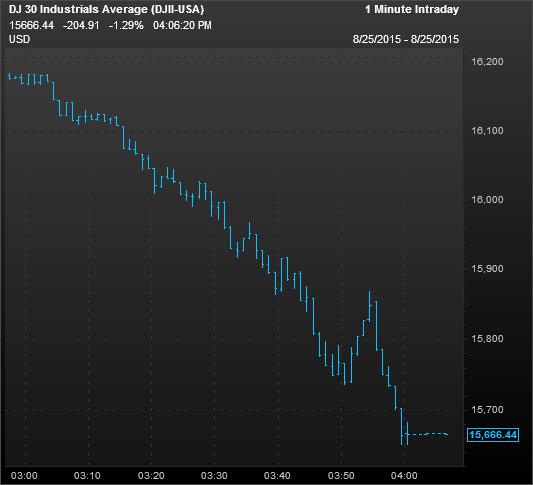

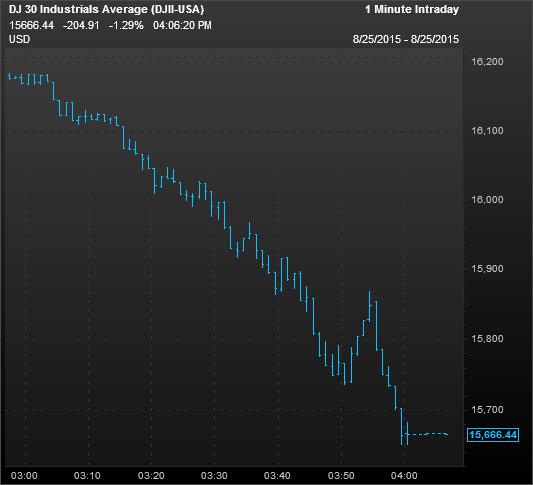

The Dow Jones industrial average and the S&P 500 closed about 1.3 percent lower after rallying nearly 3 percent earlier, their biggest reversal to the downside since Oct. 29, 2008. The S&P 500 remained in correction territory after falling there on Monday. The index also posted its first six-day losing streak since July 2012.

"That crash (Monday) was so big and so long since we had one (investors) don't want a repeat of 2008 so they bail out," said Lance Roberts, general partner at STA Wealth Management.

The Dow fell 205 points and S&P 500 closed below 1,900 after falling into negative territory in the last half hour of trade. The Nasdaq Composite failed to hold slight gains and closed 0.44 percent lower.

"Whatever triggered the consternation in the last few trading sessions is likely to be replayed again," said Mark Luschini, chief investment strategist at Janney Montgomery Scott. He said a negative close "would be a set up to grind sideways to work out this process, if this rally and enthusiasm can't last I think it's an indicator (of that consternation)."

The major averages began paring gains in late morning trade after the European close.

"This is typical after a wild swing we had yesterday," said Peter Cardillo, chief market economist at Rockwell Global Capital. "It's just going to take some time for confidence to rebuild in the market."

Earlier, the Dow gained as much as 441.5 points and the Nasdaq outperformed, up more than 3.5 percent. Morning leaders such as Netflix and Chinese stocks such as JD.com and Baidu still closed more than 4 percent higher. Alibaba gained 4.2 percent.

However, Apple clung to gains of just 0.6 percent after earlier surging more than 7 percent.

In the open, no S&P 500 stocks in the index hit new 52-week highs or lows, after about 200 names hit new 52-week lows Monday.

Morning gains fell short of recouping Monday's more-than-3.5 percent plunge and the Dow remained on pace for its biggest monthly percentage loss since February 2009 and the Nasdaq since 2008. The S&P 500 was on track for its largest percentage loss since May 2010.

"It's not as great as a bounce that many were anticipating," said Kevin Mahn, chief investment officer at Hennion and Walsh. "I think obviously the market sold off far more than it should have."

"We kind of dipped into that correction territory but we're not going to stay there," he said, noting the S&P 500 should trade more in pullback territory between 5 to 10 percent than in correction mode, between 10 to 20 percent lower.

Some of the things "bothering markets yesterday were China and collapsing commodity prices and both of those have given us some relief and when I look at China I don't look at the Shanghai market. I look at the Hong Kong market," James Meyer, chief investment officer at Tower Bridge Advisors, said of the morning rally.

The Hang Seng closed up 0.72 percent, while the Nikkei plunged 4 percent and the Shanghai Composite extended recent losses to fall below the psychologically key 3,000 mark, down 7.6 percent. However, European stocks surged, with the DAX up nearly 5 percent.

Crude oil futures settled up $1.07, or 2.80 percent, at $39.31 a barrel. Brent traded more than 1 percent higher to above $43 a barrel.

For the rally to be real "if this is the bottom we have to end strong and follow-through tomorrow," Meyer said.

Read More A Dow Theory 'sell' sign has the market nervous

In early trade Tuesday, Dow futures spiked above 600 points, implying an open of more than 450 points.

U.S. stock index futures extended gains after the Chinese central bank announced plans early in the morning ET to cut its one year lending rate to 4.6 percent, which the People's Bank of China said was provide long-term liquidity and help support the economy.

Read MoreMore selling ahead but bull market 'not dead yet'

"I'm looking for every reason to be a buyer," said Nick Raich, CEO of The Earnings Scout, who remains bearish on equities. "We're not upgrading our view at this point until we see topline growth... until then it's going to be hard to sustain a rally."

For Tuesday's open, the New York Stock Exchange invoked Rule 48 for the second day in a row, Dow Jones reported.

The exchange used the rule before Monday's open after futures for several major averages hit limit down. The last time the rule was used was during the financial crisis.

Read MoreWhat is Rule 48?

Stocks plummeted on Monday, with the S&P 500 joining the other major averages in correction territory. Nine of the 10 sectors are in correction territory, with consumer staples less than 1 percent away.

The Dow had its biggest intraday swing ever, falling as much as 1,089 points in the open on Monday. U.S. stocks closed more than 3.5 percent lower, off session lows in high volume trade as fears of slowing growth in China pressured global markets.

Cumulative trade volume was 13.94 billion shares as of 4:00 p.m. ET, the highest volume day since Aug. 10, 2011. Composite trade volume on the New York Stock Exchange was 6.57 billion shares, the heaviest since Oct. 27, 2011.

High-frequency trading accounted for 49 percent of Monday's total trade volume of 14.2 billion shares, according to TABB Group. Average daily trade volume month-to-date is 7.5 billion shares, with high-frequency trading accounting for 49 percent. During the peak levels of high-frequency trading in 2009, about 61 percent of 9.8 billion of average daily shares traded were executed by high-frequency traders.

U.S. stocks closed lower, after a failed attempt to rally from the Dow's worst 3-day point decline in history, as investor confidence waned amid continued concerns about China and global growth. ( Tweet This )

The Dow Jones industrial average and the S&P 500 closed about 1.3 percent lower after rallying nearly 3 percent earlier, their biggest reversal to the downside since Oct. 29, 2008. The S&P 500 remained in correction territory after falling there on Monday. The index also posted its first six-day losing streak since July 2012.

"That crash (Monday) was so big and so long since we had one (investors) don't want a repeat of 2008 so they bail out," said Lance Roberts, general partner at STA Wealth Management.

The Dow fell 205 points and S&P 500 closed below 1,900 after falling into negative territory in the last half hour of trade. The Nasdaq Composite failed to hold slight gains and closed 0.44 percent lower.

"Whatever triggered the consternation in the last few trading sessions is likely to be replayed again," said Mark Luschini, chief investment strategist at Janney Montgomery Scott. He said a negative close "would be a set up to grind sideways to work out this process, if this rally and enthusiasm can't last I think it's an indicator (of that consternation)."

The major averages began paring gains in late morning trade after the European close.

"This is typical after a wild swing we had yesterday," said Peter Cardillo, chief market economist at Rockwell Global Capital. "It's just going to take some time for confidence to rebuild in the market."

Earlier, the Dow gained as much as 441.5 points and the Nasdaq outperformed, up more than 3.5 percent. Morning leaders such as Netflix and Chinese stocks such as JD.com and Baidu still closed more than 4 percent higher. Alibaba gained 4.2 percent.

However, Apple clung to gains of just 0.6 percent after earlier surging more than 7 percent.

In the open, no S&P 500 stocks in the index hit new 52-week highs or lows, after about 200 names hit new 52-week lows Monday.

Morning gains fell short of recouping Monday's more-than-3.5 percent plunge and the Dow remained on pace for its biggest monthly percentage loss since February 2009 and the Nasdaq since 2008. The S&P 500 was on track for its largest percentage loss since May 2010.

"It's not as great as a bounce that many were anticipating," said Kevin Mahn, chief investment officer at Hennion and Walsh. "I think obviously the market sold off far more than it should have."

"We kind of dipped into that correction territory but we're not going to stay there," he said, noting the S&P 500 should trade more in pullback territory between 5 to 10 percent than in correction mode, between 10 to 20 percent lower.

Some of the things "bothering markets yesterday were China and collapsing commodity prices and both of those have given us some relief and when I look at China I don't look at the Shanghai market. I look at the Hong Kong market," James Meyer, chief investment officer at Tower Bridge Advisors, said of the morning rally.

The Hang Seng closed up 0.72 percent, while the Nikkei plunged 4 percent and the Shanghai Composite extended recent losses to fall below the psychologically key 3,000 mark, down 7.6 percent. However, European stocks surged, with the DAX up nearly 5 percent.

Crude oil futures settled up $1.07, or 2.80 percent, at $39.31 a barrel. Brent traded more than 1 percent higher to above $43 a barrel.

For the rally to be real "if this is the bottom we have to end strong and follow-through tomorrow," Meyer said.

Read More A Dow Theory 'sell' sign has the market nervous

In early trade Tuesday, Dow futures spiked above 600 points, implying an open of more than 450 points.

U.S. stock index futures extended gains after the Chinese central bank announced plans early in the morning ET to cut its one year lending rate to 4.6 percent, which the People's Bank of China said was provide long-term liquidity and help support the economy.

Read MoreMore selling ahead but bull market 'not dead yet'

"I'm looking for every reason to be a buyer," said Nick Raich, CEO of The Earnings Scout, who remains bearish on equities. "We're not upgrading our view at this point until we see topline growth... until then it's going to be hard to sustain a rally."

For Tuesday's open, the New York Stock Exchange invoked Rule 48 for the second day in a row, Dow Jones reported.

The exchange used the rule before Monday's open after futures for several major averages hit limit down. The last time the rule was used was during the financial crisis.

Read MoreWhat is Rule 48?

Stocks plummeted on Monday, with the S&P 500 joining the other major averages in correction territory. Nine of the 10 sectors are in correction territory, with consumer staples less than 1 percent away.

The Dow had its biggest intraday swing ever, falling as much as 1,089 points in the open on Monday. U.S. stocks closed more than 3.5 percent lower, off session lows in high volume trade as fears of slowing growth in China pressured global markets.

Cumulative trade volume was 13.94 billion shares as of 4:00 p.m. ET, the highest volume day since Aug. 10, 2011. Composite trade volume on the New York Stock Exchange was 6.57 billion shares, the heaviest since Oct. 27, 2011.

High-frequency trading accounted for 49 percent of Monday's total trade volume of 14.2 billion shares, according to TABB Group. Average daily trade volume month-to-date is 7.5 billion shares, with high-frequency trading accounting for 49 percent. During the peak levels of high-frequency trading in 2009, about 61 percent of 9.8 billion of average daily shares traded were executed by high-frequency traders.