Photographer: Justin Chin/Bloomberg

Markets

Tencent Loses $46 Billion as WeChat Ban Rocks China Markets

By

Jeanny Yu

and

Zheping Huang

August 7, 2020, 10:55 AM GMT+8Updated on August 7, 2020, 1:05 PM GMT+8

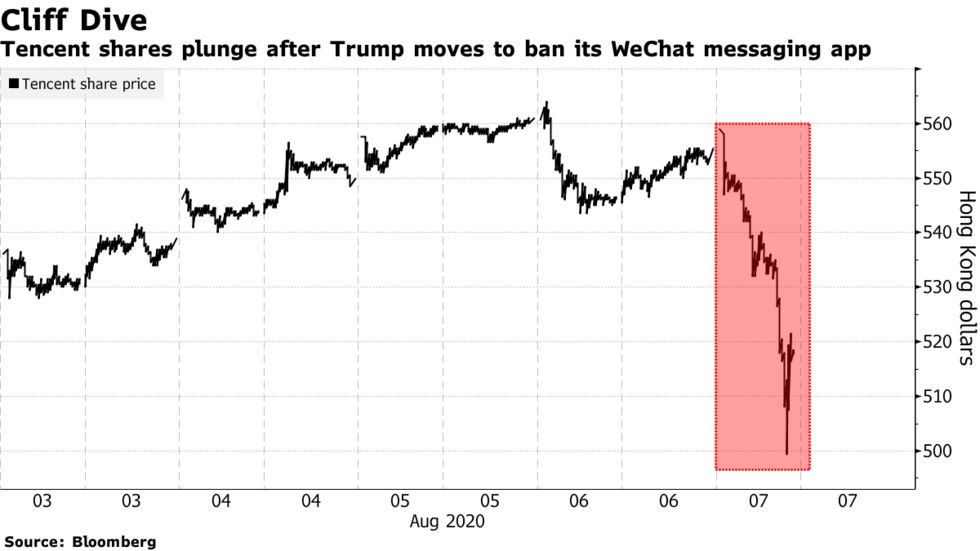

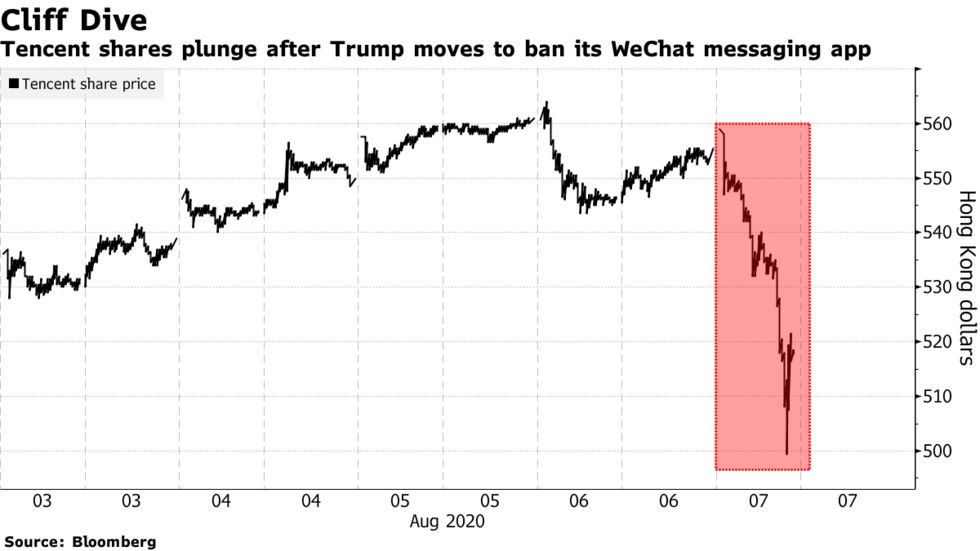

The Trump administration’s move to ban U.S. residents from doing business with Tencent Holdings Ltd.’s WeChat app rippled through Chinese markets, erasing $46 billion from the Internet giant’s market value and sending the yuan to its biggest slump in two weeks.

The U.S. president’s executive order fueled concern that the deteriorating U.S.-China relationship will weigh on companies, economies and markets. Confusion over the scope of the order led to volatile trading on Friday, with Tencent plunging more than 10% before paring its loss to 6.8% at the midday break. A U.S. official later clarified the ban will only cover WeChat.

China’s largest gaming and social media company cratered after the vaguely worded executive order raised concerns a ban could hammer not just the use of WeChat and WeChat Pay in the U.S. but extend to business relationships with some of America’s largest corporations. The world’s biggest games publisher by revenue in 2019, according to Newzoo data, it collaborates with U.S. industry leaders like Activision Blizzard Inc. and Electronics Arts Inc. It also holds a large stake in Fortnite maker Epic Games Inc. and owns League of Legends developer Riot Games Inc.

Before Friday’s drop Tencent was worth $686 billion, making it the world’s eighth-largest company by market capitalization and bigger than Berkshire Hathaway Inc. Its huge size means it occupies a dominant position on global indexes. The firm accounts for more than 6% of MSCI Inc.’s developing nation gauge and 4% of its Asian Pacific measure.

Trump’s order on WeChat came after a similar injunction against ByteDance Ltd.’s TikTok, the viral video service the White House accuses of jeopardizing national security. But Tencent is at the heart of communications between people and businesses within China and abroad, as the operator of WeChat.

“The U.S. government is expected to follow up with more measures targeting Tencent,” said Steven Leung, executive director at UOB Kay Hian (Hong Kong) Ltd. “Tencent’s overseas expansion map now looks a bit uncertain, since some M&A deals, especially if its targets are based in the U.S., will face challenges.”

(Updates with Tencent’s business from the third paragraph)

Markets

Tencent Loses $46 Billion as WeChat Ban Rocks China Markets

By

Jeanny Yu

and

Zheping Huang

August 7, 2020, 10:55 AM GMT+8Updated on August 7, 2020, 1:05 PM GMT+8

- Tech company behind the WeChat app plunges the most since 2011

- U.S. is extending campaign to curb Chinese technology firms

The Trump administration’s move to ban U.S. residents from doing business with Tencent Holdings Ltd.’s WeChat app rippled through Chinese markets, erasing $46 billion from the Internet giant’s market value and sending the yuan to its biggest slump in two weeks.

The U.S. president’s executive order fueled concern that the deteriorating U.S.-China relationship will weigh on companies, economies and markets. Confusion over the scope of the order led to volatile trading on Friday, with Tencent plunging more than 10% before paring its loss to 6.8% at the midday break. A U.S. official later clarified the ban will only cover WeChat.

China’s largest gaming and social media company cratered after the vaguely worded executive order raised concerns a ban could hammer not just the use of WeChat and WeChat Pay in the U.S. but extend to business relationships with some of America’s largest corporations. The world’s biggest games publisher by revenue in 2019, according to Newzoo data, it collaborates with U.S. industry leaders like Activision Blizzard Inc. and Electronics Arts Inc. It also holds a large stake in Fortnite maker Epic Games Inc. and owns League of Legends developer Riot Games Inc.

Before Friday’s drop Tencent was worth $686 billion, making it the world’s eighth-largest company by market capitalization and bigger than Berkshire Hathaway Inc. Its huge size means it occupies a dominant position on global indexes. The firm accounts for more than 6% of MSCI Inc.’s developing nation gauge and 4% of its Asian Pacific measure.

Trump’s order on WeChat came after a similar injunction against ByteDance Ltd.’s TikTok, the viral video service the White House accuses of jeopardizing national security. But Tencent is at the heart of communications between people and businesses within China and abroad, as the operator of WeChat.

“The U.S. government is expected to follow up with more measures targeting Tencent,” said Steven Leung, executive director at UOB Kay Hian (Hong Kong) Ltd. “Tencent’s overseas expansion map now looks a bit uncertain, since some M&A deals, especially if its targets are based in the U.S., will face challenges.”

(Updates with Tencent’s business from the third paragraph)