GetGo user disputes S$7,320 damage cost after getting into accident, claiming car was malfunctioning

There were warnings of malfunction initially, but he was assured by a GetGo staff that the car was fine after a reboot was done.Daniel Seow |

A man recently detailed his unpleasant experience with a GetGo rental vehicle in a Facebook post, after being billed S$7,320 for the damages caused by an accident.

The user claimed that the vehicle's brakes and anti-lock braking system (ABS) were not working, causing him to get into an accident on the expressway.

However, GetGo refuted his claim, saying that they did not detect any faults with the brakes and ABS during the post-accident servicing.

GetGo car could not be started initially but was rebooted successfully

Speaking to Mothership, 55-year-old Tan said that he is not an "inexperienced" driver, as he has been driving for more than 30 years.He had also used the GetGo service four times before the accident.

On Jan. 25, when he collected the five-seater Ssangyong Static, Tan noted that there was already some physical damage to the exterior of the vehicle.

He added that the vehicle dashboard lit up with "multiple warnings of malfunction", and the vehicle initially could not be started.

Tan immediately reported the existing damage using the GetGo app.

He also reached out to a GetGo customer service officer via the live chat function to report the issues, and informed her the car could not be started.

The customer service officer offered to help reboot the car remotely.

Once that was done, Tan recalls that there were no more warning signals on the dashboard, and the car could be started.

Tan claimed that the officer also told him that it was "fine" for him to drive it.

Tan assumed that "(any malfunctions) were resolved after the rebooting", so he proceeded to drive off.

The accident

On the way out of the car park, Tan says the car skidded slightly when he made a turn at low speed. At that point, he thought it was due to the oily surface in the car park.The accident happened later at around 5:38pm, when he was driving along the first lane of the Central Expressway (CTE) towards Ayer Rajah Expressway (AYE), before Bukit Timah Exit 6.

Tan wrote on Facebook:

The car was not badly damaged by the accident because he was not speeding, Tan said."The car started to swerve left and right and there was no ABS. It drifted to the next lane and I realised the brake was not working too. I tried to avoid hitting the car in front and the car started to spin. It then hit the centre guard railing twice before coming to a stop."

He also shared some pictures of the accident:

After the accident, the traffic police (TP) removed the SD card from the vehicle's car camera to conduct an investigation.

Tan says that the investigation officer could not tell from the footage if the car was malfunctioning, and the SD card was returned to Tan the next day.

On the night of the accident (Jan. 25), a GetGo Accident & Recovery staff came to his house to ask him a few questions and to get a copy of the TP and police reports.

When Tan asked about the repair costs and his liabilities, the staff told him to wait for GetGo's official email.

Tan was surprised that GetGo did not ask for the footage for their own investigation.

Slapped with S$7,320 bill

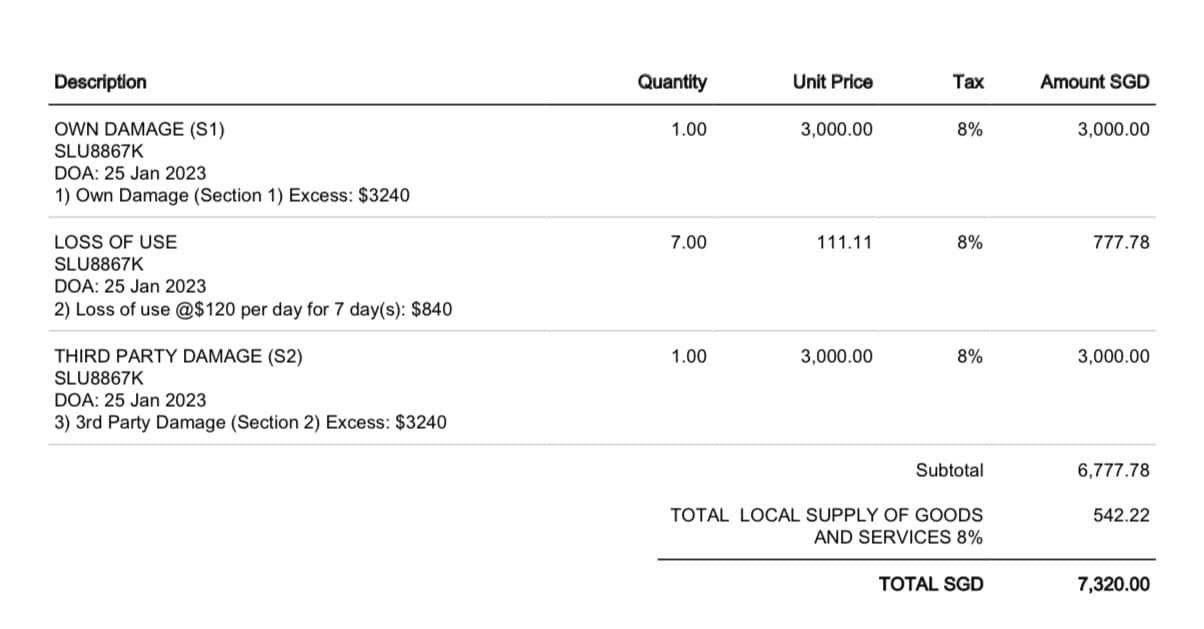

Nine days later, on Feb. 3, Tan received an invoice of S$7,320 which was to be paid within seven days.This included a repair cost of S$3,000 that did not include a detailed breakdown of the repairs or parts incurred.

GetGo also billed Tan S$840 for "loss of use" of the car for seven days, and S$3,000 for "third-party damage".

After receiving the bill, Tan was shocked because the accident claim made no mention of the car's original condition, which he reported before driving.

He subsequently emailed GetGo to lodge a dispute and has submitted an online dispute form.

Tan also requested documents from GetGo including:

- The vehicle's last maintenance and servicing report

- Proof the that car was not leased over the next seven days (for the loss of use claim)

- Details of the post accident report with photos, for a third party to provide a quotation of the repair cost.

GetGo says vehicle's brakes and ABS were not faulty

While Tan insisted that the brakes and ABS of the car were faulty, GetGo told Mothership that the car was serviced not long before the accident, on Jan. 13."During the servicing, no issues were found with the vehicle’s brakes. In addition, the post-accident servicing did not detect any faults with the car’s brakes and ABS," the GetGo spokesperson added.

GetGo also explained why some cars with minor damage are available for use:

It added this is to avoid situations where the car may be stuck in a workshop for longer durations than necessary.If a car is deemed safe to be driven, we will take note of the cost and who’s liable for it, but we may not make immediate repairs as it will remove the vehicle from the community and impact other users who may need it. An appointment will be made with the appointed workshop and the car will be sent for repairs once the required manpower and parts are available.

Breakdown of damage cost can be provided upon request

While GetGo said that they can provide a breakdown of the damage cost upon request, Tan claimed that GetGo has not yet given him a breakdown of the repair costs, and it's been more than one month after the accident.GetGo responded that such breakdowns may take longer for "complex repairs".

However, Tan was charged for seven days worth of "loss of use", which can be used as an estimate to the time needed to make necessary repairs according to GetGo.

This is based on GetGo's statement:

"The loss of use is based on the Maximum Time Charge per 24-hour booking period (Full day rate) for the vehicle as per our Terms & Conditions. The number of 24-hour periods is determined by the number of days our appointed workshop needs to make the necessary repairs."

Mothership reached out to GetGo about the delay in providing the breakdown of the repair costs. While GetGo did not provide an explanation for the delay, they shared that they are "in the process of sharing" the breakdown with Tan.

They also declined to share the breakdown with Mothership "in the interest of the user’s privacy", the spokesperson said.

GetGo: Every driver is informed of their liabilities

In the latest email to GetGo dated Mar. 3, Tan questioned why he was given the go-ahead to use the car:

"Why did the GetGo agent on the live chat go on to reboot the car and ask me to continue despite the car's condition and warning signs?"

He also said that GetGo has yet to reply to his email query on this.

According to the statement provided to Mothership, GetGo said that every driver is made aware of their liabilities before using the vehicle as they are required to take clear images of any external damage before booking the vehicle.

At the initial app walkthrough, GetGo users are also informed of their liabilities.

So how is a driver's liability determined?

GetGo said that they have insurers who will determine the liability based on the facts of the case reported by parties involved.

"We work closely with insurers to assist them to establish the liability of our users to determine if they are at fault," GetGo added.

"Third-party" damage can be waived if LTA decides not to claim for damages

Tan also asked why he was being charged S$3,000 for "third-party damage", since no other vehicles were involved in the accident.

GetGo suggested that he could request the Land Transport Authority (LTA) to check if the agency will be claiming any property damaged and they will be able to waive the "third-party damage" cost if Tan can provide a written confirmation from LTA that they will not be claiming for the property damaged on the expressway.

Tan told Mothership that his sister has helped to write in to LTA on his behalf, and LTA is processing the case.

GetGo added that users can take a Collision Damage Waiver (CDW) to reduce third-party damages by 50 per cent in the event of an accident.

Harrowing experience

Tan said that he is still traumatised by the accident.

"I have been driving for so many years and never experienced such an accident (involving) skidding and spinning. It was damn scary to feel out of control of a car," he admitted.

Tan received a "Final Reminder" for his overdue payment on Mar. 3, notifying him that he had to make payment within five working days.

The notice indicated that GetGo will take all necessary actions to collect any unpaid balance, including engaging a legal debt collector’s services.

Top image by Tan.