Violet Oon’s bid to buy out business partner goes to trial after she rejects his $6m offer

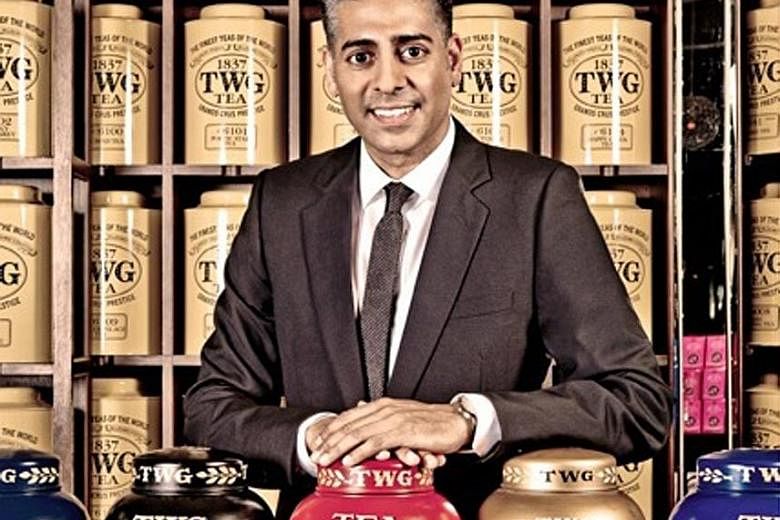

Cooking doyenne Violet Oon (seated) with her son Tay Yiming (left), daughter Tay Su-lyn (right) and business partner Manoj Murjaniin 2018. PHOTO: ST FILE

Selina Lum

Senior Law Correspondent

July 11, 2023

SINGAPORE - When Peranakan cuisine icon Violet Oon and her two children gave half of their company to businessman Manoj Murjani in 2014, they believed they had found a business partner who could take her brand international.

The number of restaurants operated by the company, Violet Oon Inc, grew from one to five, but tensions began simmering over salaries, branding, and the sharing of the financial burden.

Things boiled over in 2022 when Ms Oon, her daughter Tay Su-Lyn, and her son Tay Yiming took legal action against Mr Murjani – who is best known for co-founding luxury tea brand TWG – in a bid to buy him out.

Mr Murjani’s holding company Group MMM owns 50 per cent of Violet Oon Inc., while Ms Oon holds a 20 per cent stake and each of her children 15 per cent.

The family filed a lawsuit against him and Group MMM alleging minority oppression, as well as a parallel application to wind up the company.

In April, Mr Murjani made an offer to buy the family out for $6 million, on the condition that the family cannot use the “Violet Oon” name forever.

Ms Oon and her children turned down the offer, and on Monday, the trial opened in the High Court.

The family is seeking a court order to allow them to buy Group MMM’s shares in the company, at a price to be separately determined by the court or a court-appointed valuer.

The family, represented by Ms Meryl Koh of Drew & Napier, accused Mr Murjani of acting in a way that was “commercially unfair” to them.

They alleged that he had conducted the affairs of the company in a manner that not only caused their relationship of mutual trust and confidence to break down, but was also oppressive.

The family said they had legitimate expectations that each side would bear their fair share of the financial responsibility in running the company; that the company’s branding would remain rooted in Ms Oon’s personal identity; and that the family would be involved in the day-to-day management, while the defendants would inject funds and provide mentorship to grow the business.

Ms Koh said in her opening statement: “The company represented Ms Oon’s life’s work and the claimants’ collective dream. Within just three months of meeting him, they gave half of all that to Mr Murjani, believing that he too shared their dream and that he could help them realise it.”

No employment contracts were drawn up for Ms Oon and her children. Discussions were carried out via group chats. The first time a formal meeting was called was in 2020 after the parties’ relationship soured.

The family said that in November 2017, Mr Murjani began making demands to be inserted into the brand narrative as a co-founder of the company.

They said he pressured the family into signing an agreement under duress in February 2019, which stated that the company owed a $1.55 million loan to Group MMM, Ms Oon and Ms Tay were expelled from the board, Mr Murjani was appointed as CEO and chairman of the board, and the company was to pay him $21,000 a month.

This was after he accused them of over-paying themselves.

In December 2014, Ms Oon drew $5,000 a month, Ms Tay $1,000 and Mr Tay $4,500. By November 2018, the salaries increased respectively to $8,000, $5,000, and $8,000.

Ms Koh said expert evidence will show that the salaries were below or at par with market rates.

The family said Mr Murjani kept inflating the overpayment figure and threatened to sue them and close down the company. At the time, the company had just opened its fourth outlet at ION Orchard and was about to open its fifth at Jewel.

The family said they were forced to cede control over the company despite it being a family business.

They also accused Mr Murjani of cutting Ms Oon out of the company’s narrative, by shifting the brand to “VO Singapore” and adding the words “a Group MMM partnership”.

They added that apart from his capital injection of $750,000 to match the family’s and an additional $400,000 loan, Mr Murjani did not bear an equal share of the financial risks.

Mr Murjani, who is represented by Senior Counsel Thio Shen Yi of TSMP Law Corporation, said his offer of $6 million was “more than reasonable”. He contended that the family was trying to squeeze Group MMM out of the venture “at as lowball a price possible”.

The defendants argued that the company was not a quasi-partnership formed on the basis of mutual trust and confidence, and there were therefore no legitimate expectations beyond the written agreements.

Mr Murjani said the February 2019 agreement was not made under duress, but in the spirit of amicably moving forward and building the company together.

He denied threatening legal action and said the $1.55 million loan was the agreed remedy to resolve the issue of the family having unilaterally increased their own salaries without prior discussion, approval or consent.

Mr Murjani said he was entitled to give views on the company’s branding direction, and disagreement on branding did not constitute oppression.

“Why would Manoj invest monies for 50 per cent of the company, agree to work together with the Tays... and expend time and effort in building up the company if he were a mere bystander to a ‘family business’?” said the defendants’ opening statement.