- Joined

- Nov 29, 2016

- Messages

- 5,674

- Points

- 63

https://www.euractiv.com/section/ec...hit-by-collapse-in-investment-new-data-shows/

EU economies hit by collapse in investment, new data shows

By Grégoire Normand | La Tribune | translated by Freya Kirk

May 16, 2018

Construction accounted for about half of investments in the EU, according to Eurostat. [SparkFun Electronics/Flickr]

Most EU countries have been hit by a collapse in investment in the past decade, according to data published by Eurostat on 14 May. EURACTIV’s partner La Tribune reports.

Recent data from Eurostat, the EU’s statistical agency, revealed that capital investment (gross fixed capital formation) has fallen dramatically in 24 of the 28 member states in the 2007-2017 period.

Drop in investments

Investment decreased on average by 2.3% in the EU, falling to 20.1% of GDP in 2017 compared to 22.4% ten years ago.

Countries in Europe’s east and south, which were more vulnerable to the crisis, experienced the biggest drops in investment in the years following the crisis. Over the last decade, the greatest decline took place in Latvia, where public and private investment fell to 19.9% of GDP in 2017 compared to 36.4% in 2007, while investment in Greece fell by 13.4%, Estonia by 12.9%), Romania 12.5%, and Spain 10.4% respectively.

Troika calls for ‘strong’ debt relief for Greece

The European Central Bank has joined the IMF and European Commission’s demand for “strong” and “credible” measures to alleviate Greece’s soaring public debt (around 178% of GDP) once the country exits its rescue programme on 20 August.

Only three countries have seen their investments increase: Sweden (from 23.9% of GDP in 2007 to 24.9%), Austria by 0.6% and Germany by 0.2%.

€3.100 billion

Last year, all EU countries invested nearly €3,100 billion in public and private investments. According to Eurostat, the construction industry accounted for nearly half of investments, while machinery, equipment and weapons systems accounted for 31%, and intellectual property products 19%.

The Czech Republic’s ratio of investment to GDP is the highest in the EU, at 25.2%, followed by Sweden 24.9%, and Estonia 23.7%.

At the other end of the scale, Greece had the lowest ration of investment to GDP at 12.6%, followed by Portugal at 16.2% and the UK at 16.9%.

Juncker Plan

The European Fund for Strategic Investments was the Juncker Commission’s attempt to address the investment deficit in the EU, using the EU budget to leverage private investment. According to the European Investment Bank’s website “it aims to mobilise private investments in projects which are strategically important for the EU”.

The investment fund, Juncker’s flagship policy, has managed to disburse €284 billion to date, some way short of its target to raise €500 billion by 2020.

https://www.rt.com/business/427224-eu-economies-investment-collapse/

EU economies hit by collapse in investment

Published time: 20 May, 2018 06:53

Get short URL

Saint Peter's Basilica is seen behind a statue depicting Saint Catherine © Alessia Pierdomenico / Reuters

Investment decreased on average by 2.3 percent, falling to 20.1 percent of GDP last year. It stood at 22.4 percent from 2007 to 2017 period. Countries in Europe’s east and south, which were more vulnerable to the crisis, experienced the biggest drops in investment in the years following the crisis, Eurostat reports.

Statistics showed that only three EU countries have seen their investments increase. Those are Sweden (from 23.9 percent of GDP in 2007 to 24.9 percent), Austria by 0.6 percent and Germany by 0.2 percent.

Last year, all EU countries invested around €3 billion ($3.5 billion) in public and private investments. The construction industry accounted for nearly half of investments, while machinery, equipment and weapons systems accounted for 31 percent. Investments into intellectual property products were 19 percent.

The EU’s investment fund (the European Fund for Strategic Investments), which was set up in the aftermath of the financial crisis to address the investment deficit, has mobilized €284 billion ($335 billion) to date. It plans to raise €500 billion ($590 billion) by 2020.

According to the European Investment Bank’s website “it aims to mobilize private investments in projects which are strategically important for the EU.”

http://www.dollarsandsense.org/archives/2013/0713friedman.html

ShareThis

This article is from the July/August 2013 issue of Dollars & Sense magazine.

Subscribe Now

at a 30% discount.

Collapsing Investment and the Great Recession

BY GERALD FRIEDMAN | July/August 2013 | PDF Version

Investment in real inputs—structures and machinery used to boost future output and productivity—is one of the ways that an economy grows over time. In a capitalist economy, such investments are also crucial for macroeconomic stability and full employment because they provide an “injection” of demand to balance the “leakage” caused by personal and institutional savings. The Great Recession that began in 2007 was marked by a collapse of investment unprecedented since the Great Depression, as well as a dramatic drop in overall production and a sharp jump in unemployment. Since 2009, overall output has been growing again, but we have seen a much slower recovery of investment than after other recessions since 1947. The worst economic crisis since the 1930s, the Great Recession came after a long period of declining investment, and a break in the linkage between corporate profits and new investment.

Rising Profits, Falling Investment: The share of national income going to investment (net of depreciation of existing plant and machinery) has been declining since the beginning of the “neoliberal” era, around 1980. Since the start of the Great Recession, net investment as a share of GDP has plummeted to its lowest level since the 1930s. This sharp drop in investment comes despite sharply rising profits.

Monetary Policy Isn’t Working: The Federal Reserve has helped to shorten past recessions by driving down interest rates to lower the cost of borrowing and so spur investment. During the current crisis, the Fed has conducted an aggressive monetary policy, raising the money supply to lower interest rates. But it has had little effect on investment. While lower interest rates have had only a weak effect on investment in the past, monetary policy has had no discernible effect in the last few years, as investment rates are dramatically lower than would have been expected given the level of interest rates. Substantial excess capacity, weak expectations of future sales, and corporate strategies to shift production outside the United States all may be contributing to the lack of investment demand.

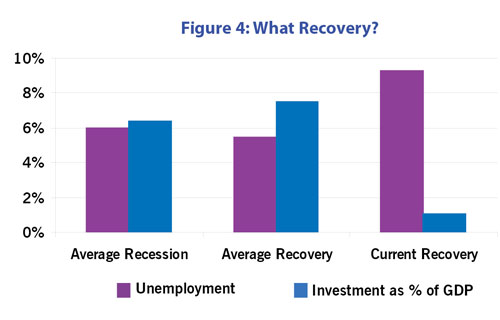

Low Investment Impedes Recovery: In one respect, the current recession resembles past experience. Low rates of investment are associated with high rates of unemployment, just as in previous economic downturns. The difference is that, three years after the official end of the Great Recession, the unemployment rate remains persistently high, and investment remains dramatically lower than in past recoveries.

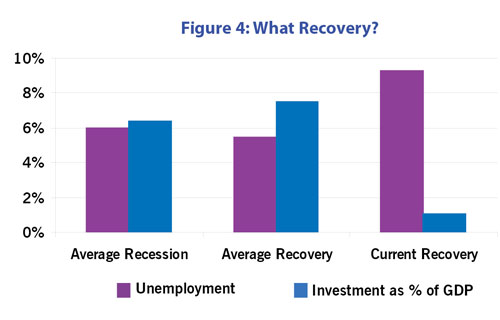

We Are Still Far from Recovering: During the current “recovery” (2009-present), the unemployment rate has remained higher and investment as a share of GDP has remained lower than the average not only for past recoveries, but even for past recessions (since 1947). No wonder the current situation seems more like a continuation of the Great Recession than a genuine recovery.

The Broken Link between Profit and Investment: In the past, higher corporate profits were associated with higher rates of investment, as businesses have rushed to take advantage of profitable opportunities. In the current crisis, however, the link between profit and investment has been broken and investment rates have been very low despite high rates of profitability (especially in 2010 and 2011). Businesses are holding back on investing, either because they anticipate continued low levels of demand (perhaps due to high unemployment and low wages) or because they plan to shift more production outside the United States.

GERALD FRIEDMAN is a professor of economics at the University of Massachusetts-Amherst.

SOURCES: Investment: Bureau of Economic Analysis (BEA, bea.gov), Table 5.2.5, Gross and Net Domestic Investment by Major Type; GDP: BEA, Current-Dollar and “Real” Gross Domestic Product; Profits: BEA, Table 1.15, Price, Costs, and Profit Per Unit of Real Gross Value Added of Nonfinancial Domestic Corporate Business; Unemployment: Bureau of Labor Statistics, Unemployment rate, 16 years and over, Not seasonally adjusted, Series ID LNU04000000; Interest rate: St. Louis Federal Reserve, Moody’s Seasoned Baa Corporate Bond Yield.

Did you find this article useful? Please consider supporting our work by donating or subscribing.

https://www.ft.com/content/b822f3fc-5829-11e8-bdb7-f6677d2e1ce8

Investment in UK clean energy suffers ‘dramatic and worrying collapse’

Sector suffers 50% fall in investment last year

May 16, 2018 Print this page 8

There has been a “dramatic and worrying collapse” in investment in clean energy in the UK in the past three years, MPs have warned.

The proportion of Britain’s electricity generated from low-carbon sources — including nuclear — has doubled between 2009 and last year, when it hit a record 50 per cent.

Yet this belies a drop in the annual investment in clean energy, which fell 10 per cent year-on-year in 2016 and another 50 per cent in 2017 — when it was at its lowest level since 2008, according to the Commons environmental audit committee.

In a report published on Wednesday, the MPs on the committee blamed the trend on a succession of Conservative-led policy decisions, including cuts to green energy subsidies.

Since 2015, ministers have privatised the Green Investment Bank, prematurely closed the renewables obligation to onshore wind, removed the climate change levy exemption for renewables and reduced feed-in tariffs for small-scale renewable generation.

The government has also cancelled the zero carbon homes policy that was due to begin in 2016 and scrapped a £1bn competition to set up a new “carbon capture and storage” plant to remove carbon dioxide from gas plants.

The MPs called on ministers to publish a plan to secure the investment needed for the UK to meet its “carbon budgets” — the milestones towards the goal of reducing carbon emissions to “net zero” by 2050.

Recommended

UK energy

Green energy push ‘costs consumers £100m a year’

Mary Creagh, the Labour MP who chairs the environmental audit committee, said billions of pounds of further investment were needed to decarbonise the entire energy system.

“A dramatic fall in investment is threatening the government’s ability to meet legally binding climate change targets,” she said, adding that the government “must urgently plug this policy gap and publish its plan to secure the investment required”.

Ministers produced a “clean growth strategy” last October, but Ms Creagh described the document as “long on aspiration but short on detail”. She said the strategy did not do enough to meet legally binding climate change targets even if all its policies were delivered in full.

The committee also called on the government to negotiate to maintain its relationship with the European Investment Bank after Brexit, allowing continued access to funding for riskier early-stage green infrastructure projects.

But the European Commission has said that the UK will lose access to the EIB after Brexit, and the Treasury has begun drawing up alternative plans.

The Department for Business, Energy and Industrial Strategy said: “The UK is a world-leader in cutting emissions, with 50 per cent of our electricity coming from low-carbon sources and recently going 72 hours without burning coal.

“We’re committed to meeting our climate change targets and will have invested £2.5bn on low carbon innovations by 2021. We will consider this report carefully and respond in full in due course.”

Copyright The Financial Times Limited 2018. All rights reserved.

EU economies hit by collapse in investment, new data shows

By Grégoire Normand | La Tribune | translated by Freya Kirk

May 16, 2018

Construction accounted for about half of investments in the EU, according to Eurostat. [SparkFun Electronics/Flickr]

Most EU countries have been hit by a collapse in investment in the past decade, according to data published by Eurostat on 14 May. EURACTIV’s partner La Tribune reports.

Recent data from Eurostat, the EU’s statistical agency, revealed that capital investment (gross fixed capital formation) has fallen dramatically in 24 of the 28 member states in the 2007-2017 period.

Drop in investments

Investment decreased on average by 2.3% in the EU, falling to 20.1% of GDP in 2017 compared to 22.4% ten years ago.

Countries in Europe’s east and south, which were more vulnerable to the crisis, experienced the biggest drops in investment in the years following the crisis. Over the last decade, the greatest decline took place in Latvia, where public and private investment fell to 19.9% of GDP in 2017 compared to 36.4% in 2007, while investment in Greece fell by 13.4%, Estonia by 12.9%), Romania 12.5%, and Spain 10.4% respectively.

Troika calls for ‘strong’ debt relief for Greece

The European Central Bank has joined the IMF and European Commission’s demand for “strong” and “credible” measures to alleviate Greece’s soaring public debt (around 178% of GDP) once the country exits its rescue programme on 20 August.

Only three countries have seen their investments increase: Sweden (from 23.9% of GDP in 2007 to 24.9%), Austria by 0.6% and Germany by 0.2%.

€3.100 billion

Last year, all EU countries invested nearly €3,100 billion in public and private investments. According to Eurostat, the construction industry accounted for nearly half of investments, while machinery, equipment and weapons systems accounted for 31%, and intellectual property products 19%.

The Czech Republic’s ratio of investment to GDP is the highest in the EU, at 25.2%, followed by Sweden 24.9%, and Estonia 23.7%.

At the other end of the scale, Greece had the lowest ration of investment to GDP at 12.6%, followed by Portugal at 16.2% and the UK at 16.9%.

Juncker Plan

The European Fund for Strategic Investments was the Juncker Commission’s attempt to address the investment deficit in the EU, using the EU budget to leverage private investment. According to the European Investment Bank’s website “it aims to mobilise private investments in projects which are strategically important for the EU”.

The investment fund, Juncker’s flagship policy, has managed to disburse €284 billion to date, some way short of its target to raise €500 billion by 2020.

https://www.rt.com/business/427224-eu-economies-investment-collapse/

EU economies hit by collapse in investment

Published time: 20 May, 2018 06:53

Get short URL

Saint Peter's Basilica is seen behind a statue depicting Saint Catherine © Alessia Pierdomenico / Reuters

- 422

Investment decreased on average by 2.3 percent, falling to 20.1 percent of GDP last year. It stood at 22.4 percent from 2007 to 2017 period. Countries in Europe’s east and south, which were more vulnerable to the crisis, experienced the biggest drops in investment in the years following the crisis, Eurostat reports.

Statistics showed that only three EU countries have seen their investments increase. Those are Sweden (from 23.9 percent of GDP in 2007 to 24.9 percent), Austria by 0.6 percent and Germany by 0.2 percent.

Last year, all EU countries invested around €3 billion ($3.5 billion) in public and private investments. The construction industry accounted for nearly half of investments, while machinery, equipment and weapons systems accounted for 31 percent. Investments into intellectual property products were 19 percent.

The EU’s investment fund (the European Fund for Strategic Investments), which was set up in the aftermath of the financial crisis to address the investment deficit, has mobilized €284 billion ($335 billion) to date. It plans to raise €500 billion ($590 billion) by 2020.

According to the European Investment Bank’s website “it aims to mobilize private investments in projects which are strategically important for the EU.”

http://www.dollarsandsense.org/archives/2013/0713friedman.html

ShareThis

This article is from the July/August 2013 issue of Dollars & Sense magazine.

Subscribe Now

at a 30% discount.

Collapsing Investment and the Great Recession

BY GERALD FRIEDMAN | July/August 2013 | PDF Version

Investment in real inputs—structures and machinery used to boost future output and productivity—is one of the ways that an economy grows over time. In a capitalist economy, such investments are also crucial for macroeconomic stability and full employment because they provide an “injection” of demand to balance the “leakage” caused by personal and institutional savings. The Great Recession that began in 2007 was marked by a collapse of investment unprecedented since the Great Depression, as well as a dramatic drop in overall production and a sharp jump in unemployment. Since 2009, overall output has been growing again, but we have seen a much slower recovery of investment than after other recessions since 1947. The worst economic crisis since the 1930s, the Great Recession came after a long period of declining investment, and a break in the linkage between corporate profits and new investment.

Rising Profits, Falling Investment: The share of national income going to investment (net of depreciation of existing plant and machinery) has been declining since the beginning of the “neoliberal” era, around 1980. Since the start of the Great Recession, net investment as a share of GDP has plummeted to its lowest level since the 1930s. This sharp drop in investment comes despite sharply rising profits.

Monetary Policy Isn’t Working: The Federal Reserve has helped to shorten past recessions by driving down interest rates to lower the cost of borrowing and so spur investment. During the current crisis, the Fed has conducted an aggressive monetary policy, raising the money supply to lower interest rates. But it has had little effect on investment. While lower interest rates have had only a weak effect on investment in the past, monetary policy has had no discernible effect in the last few years, as investment rates are dramatically lower than would have been expected given the level of interest rates. Substantial excess capacity, weak expectations of future sales, and corporate strategies to shift production outside the United States all may be contributing to the lack of investment demand.

Low Investment Impedes Recovery: In one respect, the current recession resembles past experience. Low rates of investment are associated with high rates of unemployment, just as in previous economic downturns. The difference is that, three years after the official end of the Great Recession, the unemployment rate remains persistently high, and investment remains dramatically lower than in past recoveries.

We Are Still Far from Recovering: During the current “recovery” (2009-present), the unemployment rate has remained higher and investment as a share of GDP has remained lower than the average not only for past recoveries, but even for past recessions (since 1947). No wonder the current situation seems more like a continuation of the Great Recession than a genuine recovery.

The Broken Link between Profit and Investment: In the past, higher corporate profits were associated with higher rates of investment, as businesses have rushed to take advantage of profitable opportunities. In the current crisis, however, the link between profit and investment has been broken and investment rates have been very low despite high rates of profitability (especially in 2010 and 2011). Businesses are holding back on investing, either because they anticipate continued low levels of demand (perhaps due to high unemployment and low wages) or because they plan to shift more production outside the United States.

GERALD FRIEDMAN is a professor of economics at the University of Massachusetts-Amherst.

SOURCES: Investment: Bureau of Economic Analysis (BEA, bea.gov), Table 5.2.5, Gross and Net Domestic Investment by Major Type; GDP: BEA, Current-Dollar and “Real” Gross Domestic Product; Profits: BEA, Table 1.15, Price, Costs, and Profit Per Unit of Real Gross Value Added of Nonfinancial Domestic Corporate Business; Unemployment: Bureau of Labor Statistics, Unemployment rate, 16 years and over, Not seasonally adjusted, Series ID LNU04000000; Interest rate: St. Louis Federal Reserve, Moody’s Seasoned Baa Corporate Bond Yield.

Did you find this article useful? Please consider supporting our work by donating or subscribing.

https://www.ft.com/content/b822f3fc-5829-11e8-bdb7-f6677d2e1ce8

Investment in UK clean energy suffers ‘dramatic and worrying collapse’

Sector suffers 50% fall in investment last year

- Share on Twitter (opens new window)

- Share on Facebook (opens new window)

- Share on LinkedIn (opens new window)

- Save to myFT

May 16, 2018 Print this page 8

There has been a “dramatic and worrying collapse” in investment in clean energy in the UK in the past three years, MPs have warned.

The proportion of Britain’s electricity generated from low-carbon sources — including nuclear — has doubled between 2009 and last year, when it hit a record 50 per cent.

Yet this belies a drop in the annual investment in clean energy, which fell 10 per cent year-on-year in 2016 and another 50 per cent in 2017 — when it was at its lowest level since 2008, according to the Commons environmental audit committee.

In a report published on Wednesday, the MPs on the committee blamed the trend on a succession of Conservative-led policy decisions, including cuts to green energy subsidies.

Since 2015, ministers have privatised the Green Investment Bank, prematurely closed the renewables obligation to onshore wind, removed the climate change levy exemption for renewables and reduced feed-in tariffs for small-scale renewable generation.

The government has also cancelled the zero carbon homes policy that was due to begin in 2016 and scrapped a £1bn competition to set up a new “carbon capture and storage” plant to remove carbon dioxide from gas plants.

The MPs called on ministers to publish a plan to secure the investment needed for the UK to meet its “carbon budgets” — the milestones towards the goal of reducing carbon emissions to “net zero” by 2050.

Recommended

UK energy

Green energy push ‘costs consumers £100m a year’

Mary Creagh, the Labour MP who chairs the environmental audit committee, said billions of pounds of further investment were needed to decarbonise the entire energy system.

“A dramatic fall in investment is threatening the government’s ability to meet legally binding climate change targets,” she said, adding that the government “must urgently plug this policy gap and publish its plan to secure the investment required”.

Ministers produced a “clean growth strategy” last October, but Ms Creagh described the document as “long on aspiration but short on detail”. She said the strategy did not do enough to meet legally binding climate change targets even if all its policies were delivered in full.

The committee also called on the government to negotiate to maintain its relationship with the European Investment Bank after Brexit, allowing continued access to funding for riskier early-stage green infrastructure projects.

But the European Commission has said that the UK will lose access to the EIB after Brexit, and the Treasury has begun drawing up alternative plans.

The Department for Business, Energy and Industrial Strategy said: “The UK is a world-leader in cutting emissions, with 50 per cent of our electricity coming from low-carbon sources and recently going 72 hours without burning coal.

“We’re committed to meeting our climate change targets and will have invested £2.5bn on low carbon innovations by 2021. We will consider this report carefully and respond in full in due course.”

Copyright The Financial Times Limited 2018. All rights reserved.