Founder of Alibaba Jack Ma Interview by Charlie Rose

-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Alibaba - The Story (April 2014)

- Thread starter CoffeeAhSoh

- Start date

Jack Ma (Founder, Alibaba) Interview with Shereen Bhan

http://www.straitstimes.com/breakin...-reap-3-billion-windfall-alibaba-ipo-20130927

Temasek set to reap $3-billion windfall from Alibaba IPO

Temasek Holdings looks set for a windfall from its stake in Chinese online retail giant Alibaba, which is said to be planning a mega initial public offering (IPO) in the United States.

The Singapore investment firm and three other partners took a stake worth US$1.6 billion in Alibaba in 2011, which valued the company at US$32 billion.

Today, Alibaba is estimated to be worth more than US$75 billion (S$94 billion), which means the value of Temasek's investment has doubled over two years. Some analysts have even put Alibaba's value at up to US$120 billion, according to reports by news agency Reuters.

Even if Temasek does not sell its stake as part of the IPO, it will be sitting on a major paper gain.

- See more at: http://www.straitstimes.com/breakin...all-alibaba-ipo-20130927#sthash.P9eDrICj.dpuf

Temasek set to reap $3-billion windfall from Alibaba IPO

Temasek Holdings looks set for a windfall from its stake in Chinese online retail giant Alibaba, which is said to be planning a mega initial public offering (IPO) in the United States.

The Singapore investment firm and three other partners took a stake worth US$1.6 billion in Alibaba in 2011, which valued the company at US$32 billion.

Today, Alibaba is estimated to be worth more than US$75 billion (S$94 billion), which means the value of Temasek's investment has doubled over two years. Some analysts have even put Alibaba's value at up to US$120 billion, according to reports by news agency Reuters.

Even if Temasek does not sell its stake as part of the IPO, it will be sitting on a major paper gain.

- See more at: http://www.straitstimes.com/breakin...all-alibaba-ipo-20130927#sthash.P9eDrICj.dpuf

[video]http://money.cnn.com/video/technology/2014/04/21/t-alibaba-ipo-china.cnnmoney/[/video]

http://money.cnn.com/2014/04/25/technology/alibaba-charity/index.html?iid=HP_LN

Alibaba founders fund mega charity ahead of IPO

Alibaba founder Jack Ma has created charitable trusts that could be worth more than $3 billion.

HONG KONG (CNNMoney)

The billionaire co-founder of Alibaba has set up charitable trusts ahead of the company's highly anticipated IPO, a move that could mark the start of a new era of Chinese philanthropy.

Alibaba co-founder Jack Ma, along with current CEO Joe Tsai, said Friday that they have established two trusts funded by share options worth about 2% of the company. The philanthropic effort will initially benefit environmental, medical, education and cultural causes in China, according to a statement.

Alibaba is widely expected to soon announce plans for a mega IPO that will rank among the largest in history.

Some analysts say the company is currently worth more than $170 billion -- a figure that would value the trusts at roughly $3.4 billion.

Alibaba, founded 15 years ago, has a stranglehold on the e-commerce business in China, and its online shopping sites account for about 80% of the industry.

Alibaba founders fund mega charity ahead of IPO

Alibaba founder Jack Ma has created charitable trusts that could be worth more than $3 billion.

HONG KONG (CNNMoney)

The billionaire co-founder of Alibaba has set up charitable trusts ahead of the company's highly anticipated IPO, a move that could mark the start of a new era of Chinese philanthropy.

Alibaba co-founder Jack Ma, along with current CEO Joe Tsai, said Friday that they have established two trusts funded by share options worth about 2% of the company. The philanthropic effort will initially benefit environmental, medical, education and cultural causes in China, according to a statement.

Alibaba is widely expected to soon announce plans for a mega IPO that will rank among the largest in history.

Some analysts say the company is currently worth more than $170 billion -- a figure that would value the trusts at roughly $3.4 billion.

Alibaba, founded 15 years ago, has a stranglehold on the e-commerce business in China, and its online shopping sites account for about 80% of the industry.

yeah! a money making investment! the forumers at the gardens by the bay thread should stop whinning as this alibaba investment will cover the building cost and enough for the maintenance cost for decades!

Good morning. Alibaba Group Holding Ltd.’s pending initial public offering, expected in late summer in New York and already set to be the biggest of the year, may be about to get even bigger.

The Chinese e-commerce giant and its bankers are discussing adding new shares to the deal, a move that could push its IPO beyond $20 billion, and perhaps even topping the record $22.1 billion raised by Agricultural Bank of China Ltd. in 2010, the WSJ’s Telis Demos reports. The move would allow Alibaba to raise funds for itself alongside some of its current investors.

The U.S. IPO market started the year at a rapid clip, but the recent gloom over growth stocks has caused some deals, including Chinese Internet firms Weibo Corp. and Leju Holdings Ltd., to price below their most optimistic forecasts.

The extra shares tacked onto the Alibaba IPO would generate extra cash to help it compete with China’s Tencent Holdings Ltd. as well as Google Inc. and Facebook Inc. in the U.S. “Alibaba is at the point where, after the extreme growth they’ve had, they’re going to need capital to make another huge push forward,” said Paul Boyd, managing partner of ClearPath Capital Partners, an investment adviser to technology executives.

The Chinese e-commerce giant and its bankers are discussing adding new shares to the deal, a move that could push its IPO beyond $20 billion, and perhaps even topping the record $22.1 billion raised by Agricultural Bank of China Ltd. in 2010, the WSJ’s Telis Demos reports. The move would allow Alibaba to raise funds for itself alongside some of its current investors.

The U.S. IPO market started the year at a rapid clip, but the recent gloom over growth stocks has caused some deals, including Chinese Internet firms Weibo Corp. and Leju Holdings Ltd., to price below their most optimistic forecasts.

The extra shares tacked onto the Alibaba IPO would generate extra cash to help it compete with China’s Tencent Holdings Ltd. as well as Google Inc. and Facebook Inc. in the U.S. “Alibaba is at the point where, after the extreme growth they’ve had, they’re going to need capital to make another huge push forward,” said Paul Boyd, managing partner of ClearPath Capital Partners, an investment adviser to technology executives.

Diane Sits Down With Billionaire Jack Ma

Chinese are the bestest.

Re: Alibaba and the forty thieves...

Don't fight the trend. The market is so hot, the only game is town is to punt bleeding hot stocks and flip like prata.

Buy stocks, short gold, short silver, short yen.

IPO at $68, opening trade at 92.70!

Crazy gambling den... Really...

Don't fight the trend. The market is so hot, the only game is town is to punt bleeding hot stocks and flip like prata.

Buy stocks, short gold, short silver, short yen.

Chinese are the bestest.

guessed you got it . see below :

Founder and executive chairman of Alibaba Group Jack Ma celebrates as the Alibaba stock goes live during the company's initial public offering at the New York Stock Exchange on September 19, 2014 in New York City. Alibaba shares vaulted higher in their Wall Street debut Friday, amid a wave of optimism over the prospects for the Chinese online retail giant. -- PHOTO: AFP -

NEW YORK (AFP, REUTERS) - A buying frenzy sent Alibaba shares sharply higher Friday as the Chinese online giant made its historic Wall Street trading debut.

Alibaba leapt from an offering price of US$68 to US$92.07 in the first trades, then headed to nearly US$100 before settling back at the close to US$93.89 - a hefty gain of 38 per cent that gives it a market value of US$231 billion (S$292 billion), exceeding the combined market capitalisations of Amazon and eBay, the two leading US e-commerce companies.

Company founder Jack Ma was on the floor of the New York Stock Exchange before trading opened, while a group of Alibaba customers rang the opening bell.

By raising as much as US$25 billion (S$31 billion), Chinese online giant Alibaba is poised to break the record for the largest initial public offering in history.

Priced at US$68 a share, Alibaba has raised US$21.7 billion with the offering of 320 million shares.

If underwriters exercise the option for 48 million additional shares, the amount would top US$25 billion, breaking the 2010 record set by China’s AgBank of US$22.1 billion.

Speaking to CNBC television from the trading floor, Ma said he was “very honoured, and so excited” by the market debut and that he sees enormous growth potential for Alibaba.

“We have a dream,” he said. “We hope in the next 15 years the world will change. We want to be bigger than Wal-Mart.”

He added that he sees Alibaba as a company that will have a huge impact: “We hope people say in 15 (years) this is a company like Microsoft, like IBM.”

Some analysts were also upbeat about Alibaba, which dominates the Chinese online retail space with Taobao.com and TMall.com.

“Alibaba has become the biggest e-commerce firm in the world in terms of gross merchandise volume,” the research firm Trefis said, setting a target price of US$80 per share.

“Alibaba will continue to retain the mammoth share of online shoppers, even if it is not able to increase it much.”

Youssef Squali at Cantor Fitzgerald recommending buying Alibaba. Alibaba “starts trading today and with it comes the opportunity to invest in China’s largest e-commerce platform, which we believe has the potential to dominate global online commerce over time,” the analyst said in a note to clients.

“While the stock’s not cheap, we believe the company’s outsized growth and margin profiles, if sustained, should support higher valuation over time.”

The IPO allows investors to get a piece of the huge Chinese market, but it also will fuel Alibaba’s international ambitions.

Alibaba’s consumer services are similar to a mix of those offered by US Internet titans eBay, PayPal and Amazon, and it also operates services for wholesalers.

The company earlier this year announced plans for a US marketplace called 11 Main, which is currently in a test phase.

Alibaba Group made a profit of nearly US$2 billion on revenue of US$2.5 billion in the quarter ending June 30.

Revenue rose 46 per cent from the same period a year earlier.

Alibaba decided to list in New York because it wanted an alternative class share structure to give selected minority shareholders extra control over the board; the Hong Kong bourse declined to change its rules to allow this.

A US government panel has warned of risks to investors because of a complex corporate structure.

Alibaba is registered in the Cayman Islands and controlled by a partnership through a series of shell companies.

The IPO is also a major event for US-based Yahoo, which bought a 40 per cent stake in the Chinese online giant in 2005 for US$1 billion and still holds 22.4 per cent.

The California company is expected to walk away with close to US$10 billion by paring that stake down to 16.3 per cent.

http://www.straitstimes.com/breakin...-reap-3-billion-windfall-alibaba-ipo-20130927

Temasek set to reap $3-billion windfall from Alibaba IPO

Temasek Holdings looks set for a windfall from its stake in Chinese online retail giant Alibaba, which is said to be planning a mega initial public offering (IPO) in the United States.

The Singapore investment firm and three other partners took a stake worth US$1.6 billion in Alibaba in 2011, which valued the company at US$32 billion.

Today, Alibaba is estimated to be worth more than US$75 billion (S$94 billion), which means the value of Temasek's investment has doubled over two years. Some analysts have even put Alibaba's value at up to US$120 billion, according to reports by news agency Reuters.

Even if Temasek does not sell its stake as part of the IPO, it will be sitting on a major paper gain.

- See more at: http://www.straitstimes.com/breakin...all-alibaba-ipo-20130927#sthash.P9eDrICj.dpuf

At this morning Price 19 Sep 2014 .

Temasek could have made US$ 10.00 BN

NEW YORK (AFP, REUTERS) - A buying frenzy sent Alibaba shares sharply higher Friday as the Chinese online giant made its historic Wall Street trading debut.

Alibaba leapt from an offering price of US$68 to US$92.07 in the first trades, then headed to nearly US$100 before settling back at the close to US$93.89 - a hefty gain of 38 per cent that gives it a market value of US$231 billion (S$292 billion), exceeding the combined market capitalisations of Amazon and eBay, the two leading US e-commerce companies.

[video]http://money.cnn.com/video/news/2014/09/18/alibaba-how-a-stock-is-born.cnnmoney/[/video]

This is how a stock is born

Boom: Alibaba surges 38% in huge IPO debut

By Matt Egan @mattmegan5 September 19, 2014: 4:21 PM ET

NEW YORK (CNNMoney)

Alibaba, the biggest IPO to ever hit Wall Street, made a huge splash when it started trading Friday.

Shares of the Chinese e-commerce giant closed at $93.89, marking a 38% pop from the $68 price of its record-shattering initial public offering.

The bounce signals optimism among investors about Alibaba's (BABA) ability to continue its rapid growth trajectory as China's middle class grows and and the company expands to other parts of the world.

Moments after the stock started trading, the co-founder and CEO of the company, Jack Ma, told CNNMoney he's "honored" and "humbled."

Ma told CNBC that years from now he wants Alibaba to be compared with American icons like Wal-Mart (WMT), Microsoft (MSFT, Tech30) and IBM (IBM, Tech30). People will say Alibaba "changed the world," he said.

Related: Everything you need to know about Alibaba

Alibaba opened at $92.70 and then raced to nearly $100 before sinking back below the IPO price for a few hours. The initial trading day for any stock is almost always volatile, but Alibaba's will be seen as a win.

Unlike the disastrous 2012 Facebook (FB, Tech30)IPO on Nasdaq, Alibaba's first few hours as a public company went smoothly. That's good news for the New York Stock Exchange, where Alibaba chose to list its high-profile IPO under the ticker symbol "BABA."

Alibaba raised $21.8 billion late Thursday. That's the largest ever IPO for a company listed on an American exchange.

It might turn out to be the biggest IPO in the world. Goldman Sach (GS)and the other investment banks that made the IPO happen have the option to purchase additional shares. If those options are exercised as expected, the Alibaba deal would raise $25 billion -- a global record.

Alibaba is cashing in on a very bullish overall atmosphere for stocks. The Dow and S&P 500 set new all-time records this week.

Don't worry if you've never heard of Alibaba. You haven't been living under a rock.

The Chinese company, which was founded in 1999 by former English teacher Ma, has yet to make its presence felt in the U.S. But the truckload of new cash raised by the IPO should change that.

Alibaba has largely focused on the exploding Chinese Internet market, which has already made the company a dominant player in e-commerce.

Related: Alibaba IPO means a big payday for Jack Ma

Investors are so excited about the company becasue roughly $248 billion of merchandise exchanged hands on Alibaba's platforms in 2013, according to IDC. That trumps the gross merchandise volume of Amazon.com (AMZN, Tech30), eBay (EBAY, Tech30), JD.com (JD) and Japan's Rakuten (RKUNF) -- combined.

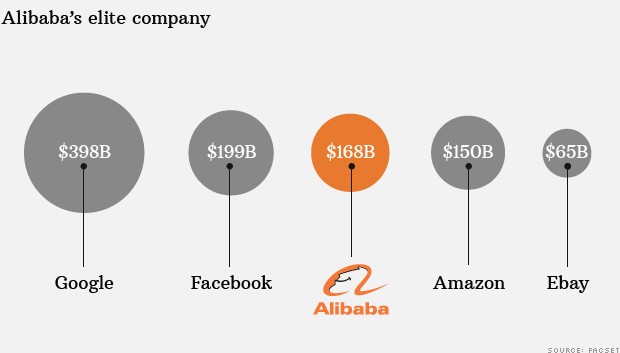

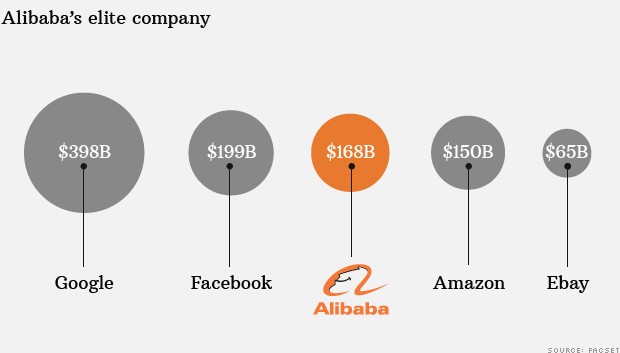

Thanks to those impressive figures, Alibaba starts life with some elite company you've definitely heard of. At the $68 IPO price, Alibaba was valued at $168 billion. That's more than Amazon.com.

After the first day of trading, Alibaba now has an even more impressive valuation of $231 billion, which is greater than Facebook and more than halfway to catching Google (GOOGL, Tech30).

Many investors like to consider the price-to-earnings ratio as a way to gauge how expensive a stock is. Based on its earnings for the year ended March 31, Alibaba is trading at a very lofty price-to-earnings multiple of 61.

Analysts at Cantor Fitzgerald launched coverage of Alibaba on Friday with a "buy" rating, although they have a price target of $90, which has already been surpassed.

"We believe that a differentiated pricing model, strong brand and unmatched scale give Alibaba an unfair competitive advantage," Cantor analyst Youssef Squali wrote in a note.

Retail investors are showing some serious interest in Alibaba. TD Ameritrade (AMTD) said Alibaba orders were on track to represent 15% of daily average revenue trades at the brokerage. By comparison, Facebook represented 22% of trades on its IPO day and Twitter (TWTR, Tech30) was about 5%.

Yahoo (YHOO, Tech30) investors are also cheering because the U.S. Internet company is cashing in a chunk of its investment in Alibaba. After taxes, Yahoo is poised to make around $5.1 billion by selling about 122 million Alibaba shares. Yahoo is holding onto a major stake that translates to billions more in value.

This is how a stock is born

Boom: Alibaba surges 38% in huge IPO debut

By Matt Egan @mattmegan5 September 19, 2014: 4:21 PM ET

NEW YORK (CNNMoney)

Alibaba, the biggest IPO to ever hit Wall Street, made a huge splash when it started trading Friday.

Shares of the Chinese e-commerce giant closed at $93.89, marking a 38% pop from the $68 price of its record-shattering initial public offering.

The bounce signals optimism among investors about Alibaba's (BABA) ability to continue its rapid growth trajectory as China's middle class grows and and the company expands to other parts of the world.

Moments after the stock started trading, the co-founder and CEO of the company, Jack Ma, told CNNMoney he's "honored" and "humbled."

Ma told CNBC that years from now he wants Alibaba to be compared with American icons like Wal-Mart (WMT), Microsoft (MSFT, Tech30) and IBM (IBM, Tech30). People will say Alibaba "changed the world," he said.

Related: Everything you need to know about Alibaba

Alibaba opened at $92.70 and then raced to nearly $100 before sinking back below the IPO price for a few hours. The initial trading day for any stock is almost always volatile, but Alibaba's will be seen as a win.

Unlike the disastrous 2012 Facebook (FB, Tech30)IPO on Nasdaq, Alibaba's first few hours as a public company went smoothly. That's good news for the New York Stock Exchange, where Alibaba chose to list its high-profile IPO under the ticker symbol "BABA."

Alibaba raised $21.8 billion late Thursday. That's the largest ever IPO for a company listed on an American exchange.

It might turn out to be the biggest IPO in the world. Goldman Sach (GS)and the other investment banks that made the IPO happen have the option to purchase additional shares. If those options are exercised as expected, the Alibaba deal would raise $25 billion -- a global record.

Alibaba is cashing in on a very bullish overall atmosphere for stocks. The Dow and S&P 500 set new all-time records this week.

Don't worry if you've never heard of Alibaba. You haven't been living under a rock.

The Chinese company, which was founded in 1999 by former English teacher Ma, has yet to make its presence felt in the U.S. But the truckload of new cash raised by the IPO should change that.

Alibaba has largely focused on the exploding Chinese Internet market, which has already made the company a dominant player in e-commerce.

Related: Alibaba IPO means a big payday for Jack Ma

Investors are so excited about the company becasue roughly $248 billion of merchandise exchanged hands on Alibaba's platforms in 2013, according to IDC. That trumps the gross merchandise volume of Amazon.com (AMZN, Tech30), eBay (EBAY, Tech30), JD.com (JD) and Japan's Rakuten (RKUNF) -- combined.

Thanks to those impressive figures, Alibaba starts life with some elite company you've definitely heard of. At the $68 IPO price, Alibaba was valued at $168 billion. That's more than Amazon.com.

After the first day of trading, Alibaba now has an even more impressive valuation of $231 billion, which is greater than Facebook and more than halfway to catching Google (GOOGL, Tech30).

Many investors like to consider the price-to-earnings ratio as a way to gauge how expensive a stock is. Based on its earnings for the year ended March 31, Alibaba is trading at a very lofty price-to-earnings multiple of 61.

Analysts at Cantor Fitzgerald launched coverage of Alibaba on Friday with a "buy" rating, although they have a price target of $90, which has already been surpassed.

"We believe that a differentiated pricing model, strong brand and unmatched scale give Alibaba an unfair competitive advantage," Cantor analyst Youssef Squali wrote in a note.

Retail investors are showing some serious interest in Alibaba. TD Ameritrade (AMTD) said Alibaba orders were on track to represent 15% of daily average revenue trades at the brokerage. By comparison, Facebook represented 22% of trades on its IPO day and Twitter (TWTR, Tech30) was about 5%.

Yahoo (YHOO, Tech30) investors are also cheering because the U.S. Internet company is cashing in a chunk of its investment in Alibaba. After taxes, Yahoo is poised to make around $5.1 billion by selling about 122 million Alibaba shares. Yahoo is holding onto a major stake that translates to billions more in value.

[video]http://money.cnn.com/video/technology/2014/09/04/who-is-jack-ma-alibaba.cnnmoney/index.html[/video]

Did any ah gong buy alibaba at ultra high price of $99?

http://money.cnn.com/2014/04/25/technology/alibaba-charity/index.html?iid=HP_LN

Alibaba founders fund mega charity ahead of IPO

Alibaba founder Jack Ma has created charitable trusts that could be worth more than $3 billion.

Bill Gates, Warren Buffet,.... are poorer than LKY but they are giving back to society.

So when can we expect a 90+ old fart to set up a charity trust

Did any ah gong buy alibaba at ultra high price of $99?

Never buy during an IPO because there is so much interest. Look what happened to Facbook. The price dropped before rising. If you want to buy then you should buy after a pull back

Ali Baba: Biggest IPO in History at US$25 bil

Alibaba IPO ranks as world's biggest after additional shares sold

By Reuters | 22 Sep, 2014, 08.41AM IST

READ MORE ON » The move | Shares | Joe Tsai | Jack Ma | IPO | Insurability | Alibaba Yahoo Inc

HONG KONG: Alibaba Group Holding Ltd's initial public offering now ranks as the world's biggest in history at $25 billion, after the e-commerce giant and some of its shareholders sold additional shares.

Overwhelming demand saw the IPO initially raise $21.8 billion and then send Alibaba's stock surging 38 percent in its debut on Friday. That prompted underwriters to exercise an option to sell an additional 48 million shares, a source with direct knowledge of the deal said.

The IPO surpassed the previous global record set by Agricultural Bank of China Ltd in 2010 when the bank raised $22.1 billion.

Under the option, Alibaba agreed to sell 26.1 million additional shares and Yahoo Inc 18.3 million, netting the two companies an extra $1.8 billion and $1.2 billion respectively.

Alibaba's Jack Ma agreed to sell an extra 2.7 million shares and company co-founder Joe Tsai agreed to sell 902,782 additional shares, according to the prospectus.

The source declined to be identified as the details of the additional sale have yet to be made official. Alibaba declined to comment.

Citigroup Inc, Credit Suisse Group AG, Deutsche Bank, Goldman Sachs Group Inc, JPMorgan Chase & Co and Morgan Stanley acted as joint bookrunners of the IPO.

Rothschild was hired as Alibaba's independent financial advisor on the deal.

Alibaba IPO ranks as world's biggest after additional shares sold

By Reuters | 22 Sep, 2014, 08.41AM IST

READ MORE ON » The move | Shares | Joe Tsai | Jack Ma | IPO | Insurability | Alibaba Yahoo Inc

HONG KONG: Alibaba Group Holding Ltd's initial public offering now ranks as the world's biggest in history at $25 billion, after the e-commerce giant and some of its shareholders sold additional shares.

Overwhelming demand saw the IPO initially raise $21.8 billion and then send Alibaba's stock surging 38 percent in its debut on Friday. That prompted underwriters to exercise an option to sell an additional 48 million shares, a source with direct knowledge of the deal said.

The IPO surpassed the previous global record set by Agricultural Bank of China Ltd in 2010 when the bank raised $22.1 billion.

Under the option, Alibaba agreed to sell 26.1 million additional shares and Yahoo Inc 18.3 million, netting the two companies an extra $1.8 billion and $1.2 billion respectively.

Alibaba's Jack Ma agreed to sell an extra 2.7 million shares and company co-founder Joe Tsai agreed to sell 902,782 additional shares, according to the prospectus.

The source declined to be identified as the details of the additional sale have yet to be made official. Alibaba declined to comment.

Citigroup Inc, Credit Suisse Group AG, Deutsche Bank, Goldman Sachs Group Inc, JPMorgan Chase & Co and Morgan Stanley acted as joint bookrunners of the IPO.

Rothschild was hired as Alibaba's independent financial advisor on the deal.

Similar threads

- Replies

- 15

- Views

- 1K

- Replies

- 0

- Views

- 661

- Replies

- 42

- Views

- 4K

- Replies

- 3

- Views

- 787