3 Countries Agree To Launch BRICS Currency To Challenge US Dollar

watcher.guru

A new BRICS currency could soon be a reality as three countries have agreed to launch the tender to challenge the US dollar. The BRICS alliance is looking to replace the US dollar with a new currency creating a new world order. The bloc is advancing towards producing a ‘multipolar world’ where the US and its Western allies will no longer have power and control over other nations

Also Read: BRICS: JP Morgan Predicts Future of the US Dollar Against Chinese Yuan

The group is convincing developing nations in Asia, Africa, and South America to ditch the US dollar and embrace the soon-to-be-changing financial world. Read here to know how many sectors in the US will be affected if BRICS stops using the dollar for trade.

The group is convincing developing nations in Asia, Africa, and South America to ditch the US dollar and embrace the soon-to-be-changing financial world. Read here to know how many sectors in the US will be affected if BRICS stops using the dollar for trade.

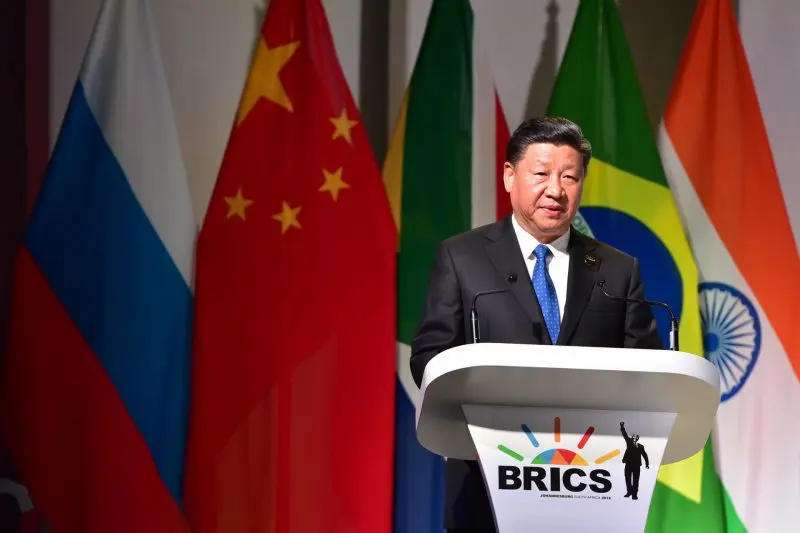

Source: AFP

Source: AFP

In the latest update, Russia’s former advisor to President Vladimir Putin and economist-turned-politician, Sergey Glazyev, confirmed that the new currency is in the works and is “almost ready”. He explained that three out of the five original founding countries have agreed to launch the new currency.

Also Read: These 25 Countries Are Ready To Join BRICS in 2024

Glazyev stressed that only India and China are yet to give their nod for the formation of a new currency. The politician said that the alliance will go ahead only after other members agree and come to a consensus.

“To launch this currency, we need the political consent of the BRICS countries. Three of which have already expressed their support for the idea,” Sergey Galzyev stated. The Russian politician added, “We are waiting for the reaction of China and India”.

Also Read: BRICS: Investors Bet Indian Rupee Will Rise, US Dollar To Decline

In conclusion, the only thing that’s stopping BRICS from launching their new currency is political consent from India and China. The rest of the three original founding countries Brazil, Russia, and South Africa have agreed to the BRICS currency. The extended new members are yet to come to a common consensus with the BRICS currency.

watcher.guru

A new BRICS currency could soon be a reality as three countries have agreed to launch the tender to challenge the US dollar. The BRICS alliance is looking to replace the US dollar with a new currency creating a new world order. The bloc is advancing towards producing a ‘multipolar world’ where the US and its Western allies will no longer have power and control over other nations

Also Read: BRICS: JP Morgan Predicts Future of the US Dollar Against Chinese Yuan

In the latest update, Russia’s former advisor to President Vladimir Putin and economist-turned-politician, Sergey Glazyev, confirmed that the new currency is in the works and is “almost ready”. He explained that three out of the five original founding countries have agreed to launch the new currency.

Also Read: These 25 Countries Are Ready To Join BRICS in 2024

Glazyev stressed that only India and China are yet to give their nod for the formation of a new currency. The politician said that the alliance will go ahead only after other members agree and come to a consensus.

“To launch this currency, we need the political consent of the BRICS countries. Three of which have already expressed their support for the idea,” Sergey Galzyev stated. The Russian politician added, “We are waiting for the reaction of China and India”.

Also Read: BRICS: Investors Bet Indian Rupee Will Rise, US Dollar To Decline

In conclusion, the only thing that’s stopping BRICS from launching their new currency is political consent from India and China. The rest of the three original founding countries Brazil, Russia, and South Africa have agreed to the BRICS currency. The extended new members are yet to come to a common consensus with the BRICS currency.