Thank goodness there is a court trial and the world can hear the juicy details.

A photo from May 16, 2019, shows banker Roger Ng (left) leaving a US federal court in New York. PHOTO: WES BRUER/BLOOMBERG

FEB 7, 2022

NEW YORK (BLOOMBERG) - Day after day, the scene has replayed: Roger Ng, a former Goldman Sachs banker, leaves his Manhattan apartment and, with an electronic monitor strapped to his ankle, heads downtown to build the case that might save him from prison.

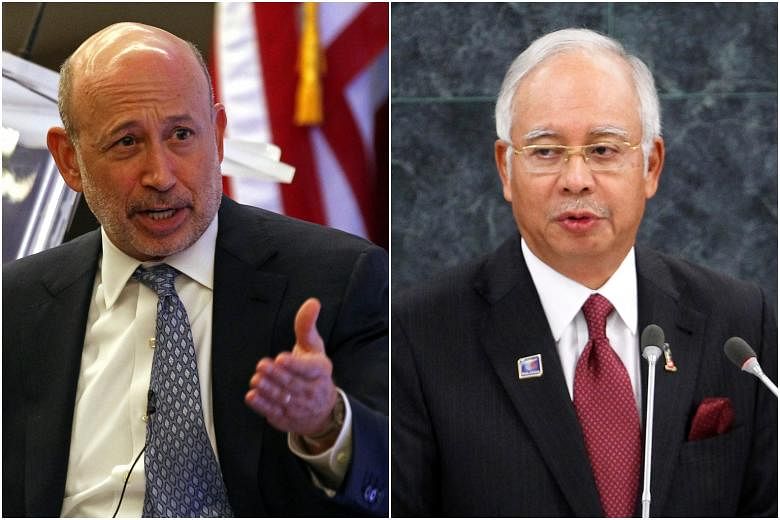

It has been nearly three years since Ng landed in the United States from South-east Asia to face federal charges over his role in a scheme to loot billions from the Malaysian fund known as 1Malaysia Development Berhad, or 1MDB. In that time Malaysia's former prime minister Najib Razak has been convicted of crimes while Goldman has paid US$5 billion (S$6.7 billion) in fines and apologised for breaking the law, one of the biggest black marks in its 153-year history.

Now, at long last, Ng is about to get his day in court - as the only person in all of Goldman Sachs to stand trial in the US for a scandal that stretched from Singapore to Hollywood to Wall Street and beyond. He has pleaded not guilty.

Free on a US$20 million bond, Ng, 49, has been confined to his apartment except for runs on Manhattan's West Side, trips to the grocery store and his lawyer's office. He has spent his days at that office poring over millions of documents in the sprawling case. He sits at a desk that was previously occupied by "Pharma Bro" Martin Shkreli, who was sentenced to prison for securities fraud in 2018, in another high-profile legal drama.

Ng's trial, delayed for two years because of the coronavirus pandemic, is finally set to begin with jury selection on Monday and is expected to last at least five weeks. Ng faces as many as 30 years in prison.

"No one expected him to be here for three years," his lawyer Marc Agnifilo said at a recent hearing. Ng and Agnifilo declined to comment for this story.

While his defence team has cast Ng as a deputy to star Goldman banker Tim Leissner and the first to warn compliance about Malaysian financier Jho Low, prosecutors say Ng played a critical role in a bribe-paying and money laundering scheme.

By now the broad outlines of the 1MDB scandal, or at least its most salacious details, are well known on Wall Street. There is the gob-smacking dollar figure: US$2.7 billion supposedly plundered, the scheme greased by bribes to various officials in Malaysia and Abu Dhabi. Some of the money went to a US$200 million superyacht. Some went to paintings by Monet, van Gogh and Basquiat. Still more went to finance a movie based on other real-life market mayhem: The Wolf Of Wall Street.

The US says the "brazen" scheme could not have been pulled off without help of bankers at Goldman Sachs.

Ng, the former head of investment banking in Malaysia, is charged with helping Low and Leissner launder billions of dollars embezzled from 1MDB. He is also charged with violating US anti-bribery laws.

Low, the alleged mastermind of the fraud, has denied wrongdoing and remains at large. Leissner secretly pleaded guilty in 2018 to conspiring to violate US anti-bribery laws, as well as to engaging in a money laundering conspiracy. Leissner agreed to cooperate with the US and is expected to be a star witness at Ng's trial.

Ng has said he was the first to inform Goldman Sachs compliance about Low, sending "red flag warnings" not to do business with him. Mr Agnifilo, Ng's lawyer, has also said Leissner cooperated with the US and implicated Ng to save himself.

Mr Agnifilo contends that Ng played no role in the fraud.

The case against Ng focuses on Goldman's fund-raising work in 2012 and 2013 for 1MDB that raised about US$6.5 billion in three transactions. The first was Project Magnolia, a US$1.75 billion debt-financing deal to purchase a Malaysian energy company.

While assuring superiors Low was not involved, Ng and Leissner allegedly agreed to pay bribes to officials to facilitate the bond deal, of which US$577 million was diverted to pay officials like Najib, prosecutors said. Low and others collected US$295 million, while about US$60 million was diverted to a company co-founded by Najib's stepson and helped finance The Wolf Of Wall Street, according to the US.

Ng ultimately received about US$35 million diverted from 1MDB into an account "managed and controlled" by his wife, prosecutors say. Ng's wife has not been charged with wrongdoing.

Leissner, who agreed to forfeit US$43.7 million and awaits sentencing later this year, could face as long as 25 years in prison. His lawyer Henry Mazurek did not return a call seeking comment.

Ng was arrested in Malaysia in late 2018 and agreed to come to the US the next year. Even if he prevails in the US, his legal battle will not end there: He still faces separate trial in Malaysia.

Only Goldman banker to stand trial for 1MDB to get his day in court today

A photo from May 16, 2019, shows banker Roger Ng (left) leaving a US federal court in New York. PHOTO: WES BRUER/BLOOMBERG

FEB 7, 2022

NEW YORK (BLOOMBERG) - Day after day, the scene has replayed: Roger Ng, a former Goldman Sachs banker, leaves his Manhattan apartment and, with an electronic monitor strapped to his ankle, heads downtown to build the case that might save him from prison.

It has been nearly three years since Ng landed in the United States from South-east Asia to face federal charges over his role in a scheme to loot billions from the Malaysian fund known as 1Malaysia Development Berhad, or 1MDB. In that time Malaysia's former prime minister Najib Razak has been convicted of crimes while Goldman has paid US$5 billion (S$6.7 billion) in fines and apologised for breaking the law, one of the biggest black marks in its 153-year history.

Now, at long last, Ng is about to get his day in court - as the only person in all of Goldman Sachs to stand trial in the US for a scandal that stretched from Singapore to Hollywood to Wall Street and beyond. He has pleaded not guilty.

Free on a US$20 million bond, Ng, 49, has been confined to his apartment except for runs on Manhattan's West Side, trips to the grocery store and his lawyer's office. He has spent his days at that office poring over millions of documents in the sprawling case. He sits at a desk that was previously occupied by "Pharma Bro" Martin Shkreli, who was sentenced to prison for securities fraud in 2018, in another high-profile legal drama.

Ng's trial, delayed for two years because of the coronavirus pandemic, is finally set to begin with jury selection on Monday and is expected to last at least five weeks. Ng faces as many as 30 years in prison.

"No one expected him to be here for three years," his lawyer Marc Agnifilo said at a recent hearing. Ng and Agnifilo declined to comment for this story.

While his defence team has cast Ng as a deputy to star Goldman banker Tim Leissner and the first to warn compliance about Malaysian financier Jho Low, prosecutors say Ng played a critical role in a bribe-paying and money laundering scheme.

By now the broad outlines of the 1MDB scandal, or at least its most salacious details, are well known on Wall Street. There is the gob-smacking dollar figure: US$2.7 billion supposedly plundered, the scheme greased by bribes to various officials in Malaysia and Abu Dhabi. Some of the money went to a US$200 million superyacht. Some went to paintings by Monet, van Gogh and Basquiat. Still more went to finance a movie based on other real-life market mayhem: The Wolf Of Wall Street.

The US says the "brazen" scheme could not have been pulled off without help of bankers at Goldman Sachs.

Ng, the former head of investment banking in Malaysia, is charged with helping Low and Leissner launder billions of dollars embezzled from 1MDB. He is also charged with violating US anti-bribery laws.

Low, the alleged mastermind of the fraud, has denied wrongdoing and remains at large. Leissner secretly pleaded guilty in 2018 to conspiring to violate US anti-bribery laws, as well as to engaging in a money laundering conspiracy. Leissner agreed to cooperate with the US and is expected to be a star witness at Ng's trial.

Ng has said he was the first to inform Goldman Sachs compliance about Low, sending "red flag warnings" not to do business with him. Mr Agnifilo, Ng's lawyer, has also said Leissner cooperated with the US and implicated Ng to save himself.

Mr Agnifilo contends that Ng played no role in the fraud.

The case against Ng focuses on Goldman's fund-raising work in 2012 and 2013 for 1MDB that raised about US$6.5 billion in three transactions. The first was Project Magnolia, a US$1.75 billion debt-financing deal to purchase a Malaysian energy company.

While assuring superiors Low was not involved, Ng and Leissner allegedly agreed to pay bribes to officials to facilitate the bond deal, of which US$577 million was diverted to pay officials like Najib, prosecutors said. Low and others collected US$295 million, while about US$60 million was diverted to a company co-founded by Najib's stepson and helped finance The Wolf Of Wall Street, according to the US.

Ng ultimately received about US$35 million diverted from 1MDB into an account "managed and controlled" by his wife, prosecutors say. Ng's wife has not been charged with wrongdoing.

Leissner, who agreed to forfeit US$43.7 million and awaits sentencing later this year, could face as long as 25 years in prison. His lawyer Henry Mazurek did not return a call seeking comment.

Ng was arrested in Malaysia in late 2018 and agreed to come to the US the next year. Even if he prevails in the US, his legal battle will not end there: He still faces separate trial in Malaysia.