https://www.washingtonpost.com/world/interactive/2023/ev-lithium-afghanistan-taliban-china/

CHAPA DARA, Afghanistan — Sayed Wali Sajid spent years fighting American soldiers in the barren hills and fertile fields of the Pech River Valley, one of the deadliest theaters of the 20-year insurgency. But nothing confounded the Taliban commander, he said, like the new wave of foreigners who began showing up, one after another, in late 2021.

Once, Sajid spotted a foreigner hiking alone along a path where Islamic State extremists were known to kidnap outsiders. Another time, five men and women evaded Sajid’s soldiers in the dark to scour the mountain. The newcomers, Sajid recalled, were giddy, persistent, almost single-minded in their quest for something few locals believed held any value at all.

“The Chinese were unbelievable,” Sajid said, chuckling at the memory. “At first, they didn’t tell us what they wanted. But then I saw the excitement in their eyes and their eagerness, and that’s when I understood the word ‘lithium.’”

A decade earlier, the U.S. Defense Department, guided by the surveys of American government geologists, concluded that the vast wealth of lithium and other minerals buried in Afghanistan might be worth $1 trillion, more than enough to prop up the country’s fragile government. In a 2010 memo, the Pentagon’s Task Force for Business and Stability Operations, which examined Afghanistan’s development potential, dubbed the country the “Saudi Arabia of lithium.” A year later, the U.S. Geological Survey published a map showing the location of major deposits and highlighted the magnitude of the underground wealth, saying Afghanistan “could be considered as the world’s recognized future principal source of lithium.”

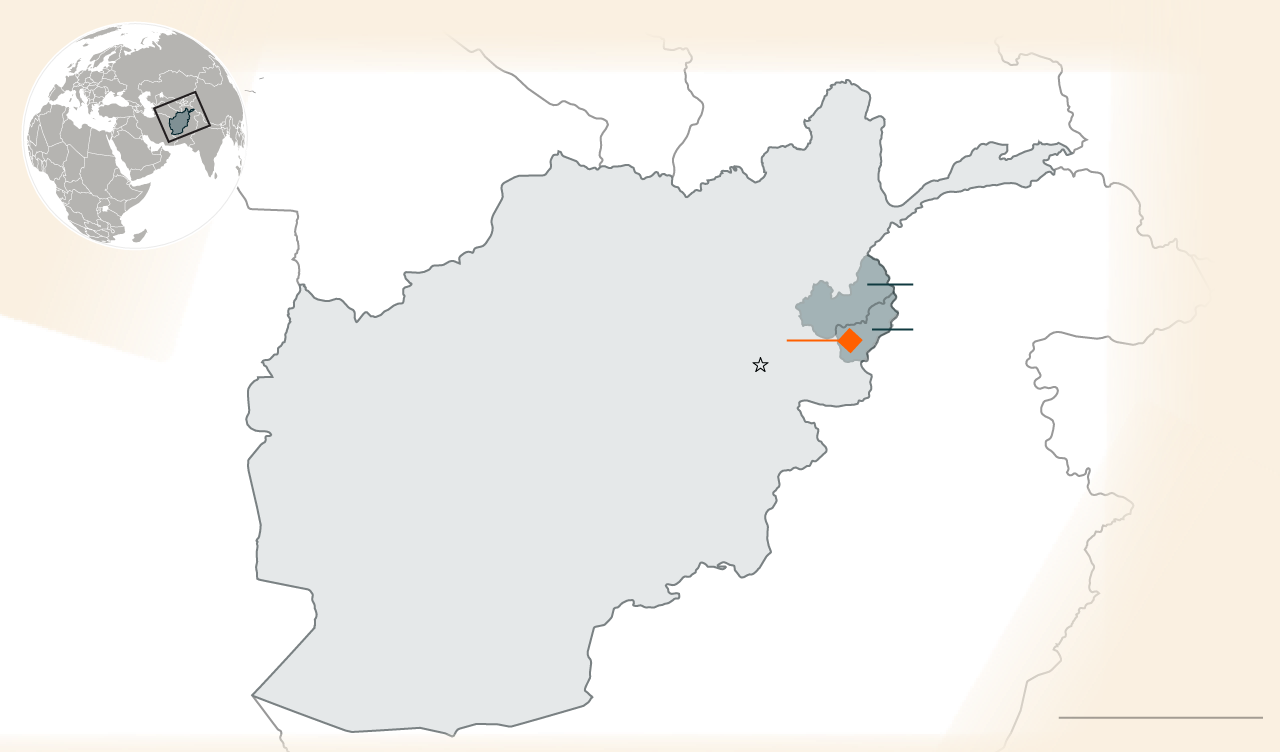

UZBEK.

TAJIK.

CHINA

TURKMEN.

Detail

NURESTAN

KONAR

Chapa Dara

Kabul

AFGHANISTAN

IRAN

PAKISTAN

200 MILES

But now, in a great twist of modern Afghan history, it is the Taliban — which overthrew the U.S.-backed government two years ago — that is finally looking to exploit those vast lithium reserves, at a time when the soaring global popularity of electric vehicles is spurring an urgent need for the mineral, a vital ingredient in their batteries. By 2040, demand for lithium could rise 40-fold from 2020 levels, according to the International Energy Agency.

Afghanistan remains under intense international pressure — isolated politically and saddled with U.S. and multilateral sanctions because of human rights concerns, in particular the repression of women, and Taliban links to terrorism. The tremendous promise of lithium, however, could frustrate Western efforts to squeeze the Taliban into changing its extremist ways. And with the United States absent from Afghanistan, it is Chinese companies that are now aggressively positioning themselves to reap a windfall from lithium here — and, in doing so, further tighten China’s grasp on much of the global supply chain for EV minerals.

The surging demand for lithium is part of a worldwide scramble for a variety of metals used in the manufacture of EVs, widely considered crucial to the green-energy transition. But the mining and processing of minerals such as nickel, cobalt and manganese often come with unintended consequences — for instance, harm to workers, surrounding communities and the environment. In Afghanistan, those consequences look to be geopolitical: the potential enrichment of the largely shunned Taliban and another leg up for China in a fierce, strategic competition.

Sayed Wali Sajid, a Taliban commander who serves as governor of the Chapa Dara district of Konar province, is in charge of an area rich with minerals.

Around the time Kabul fell to the Taliban in August 2021, a boom shook the world’s lithium market. The mineral’s price skyrocketed eightfold from 2021 to 2022, attracting hundreds of Chinese mining entrepreneurs to Afghanistan.

In interviews, Taliban officials, Chinese entrepreneurs and their Afghan intermediaries described a frenzy reminiscent of a 19th-century gold rush. Globe-trotting Chinese traders packed into Kabul’s hotels, racing to source lithium in the hinterlands. Chinese executives filed into meetings with Taliban leaders, angling for exploration rights. In January, Taliban officials arrested a Chinese businessman for allegedly smuggling 1,000 tons of lithium ore from Konar province to China via Pakistan.

CHAPA DARA, Afghanistan — Sayed Wali Sajid spent years fighting American soldiers in the barren hills and fertile fields of the Pech River Valley, one of the deadliest theaters of the 20-year insurgency. But nothing confounded the Taliban commander, he said, like the new wave of foreigners who began showing up, one after another, in late 2021.

Once, Sajid spotted a foreigner hiking alone along a path where Islamic State extremists were known to kidnap outsiders. Another time, five men and women evaded Sajid’s soldiers in the dark to scour the mountain. The newcomers, Sajid recalled, were giddy, persistent, almost single-minded in their quest for something few locals believed held any value at all.

“The Chinese were unbelievable,” Sajid said, chuckling at the memory. “At first, they didn’t tell us what they wanted. But then I saw the excitement in their eyes and their eagerness, and that’s when I understood the word ‘lithium.’”

A decade earlier, the U.S. Defense Department, guided by the surveys of American government geologists, concluded that the vast wealth of lithium and other minerals buried in Afghanistan might be worth $1 trillion, more than enough to prop up the country’s fragile government. In a 2010 memo, the Pentagon’s Task Force for Business and Stability Operations, which examined Afghanistan’s development potential, dubbed the country the “Saudi Arabia of lithium.” A year later, the U.S. Geological Survey published a map showing the location of major deposits and highlighted the magnitude of the underground wealth, saying Afghanistan “could be considered as the world’s recognized future principal source of lithium.”

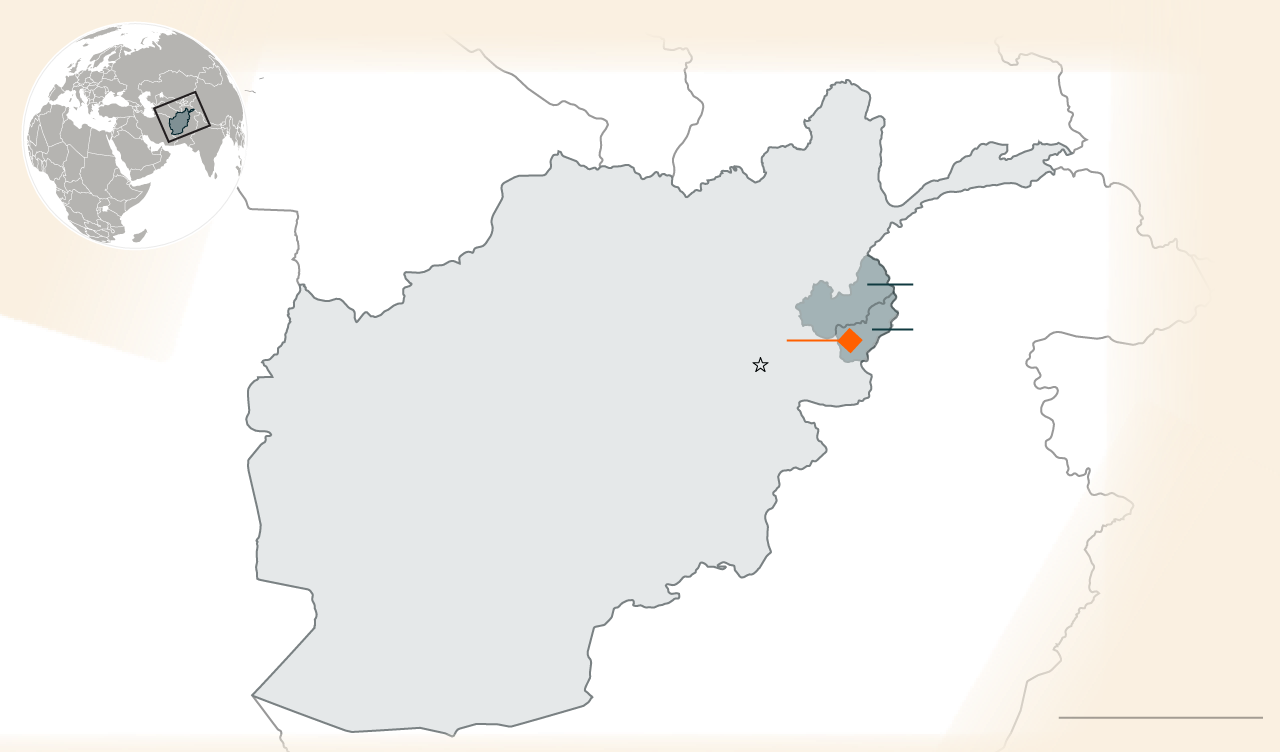

UZBEK.

TAJIK.

CHINA

TURKMEN.

Detail

NURESTAN

KONAR

Chapa Dara

Kabul

AFGHANISTAN

IRAN

PAKISTAN

200 MILES

But now, in a great twist of modern Afghan history, it is the Taliban — which overthrew the U.S.-backed government two years ago — that is finally looking to exploit those vast lithium reserves, at a time when the soaring global popularity of electric vehicles is spurring an urgent need for the mineral, a vital ingredient in their batteries. By 2040, demand for lithium could rise 40-fold from 2020 levels, according to the International Energy Agency.

Afghanistan remains under intense international pressure — isolated politically and saddled with U.S. and multilateral sanctions because of human rights concerns, in particular the repression of women, and Taliban links to terrorism. The tremendous promise of lithium, however, could frustrate Western efforts to squeeze the Taliban into changing its extremist ways. And with the United States absent from Afghanistan, it is Chinese companies that are now aggressively positioning themselves to reap a windfall from lithium here — and, in doing so, further tighten China’s grasp on much of the global supply chain for EV minerals.

The surging demand for lithium is part of a worldwide scramble for a variety of metals used in the manufacture of EVs, widely considered crucial to the green-energy transition. But the mining and processing of minerals such as nickel, cobalt and manganese often come with unintended consequences — for instance, harm to workers, surrounding communities and the environment. In Afghanistan, those consequences look to be geopolitical: the potential enrichment of the largely shunned Taliban and another leg up for China in a fierce, strategic competition.

Sayed Wali Sajid, a Taliban commander who serves as governor of the Chapa Dara district of Konar province, is in charge of an area rich with minerals.

Around the time Kabul fell to the Taliban in August 2021, a boom shook the world’s lithium market. The mineral’s price skyrocketed eightfold from 2021 to 2022, attracting hundreds of Chinese mining entrepreneurs to Afghanistan.

In interviews, Taliban officials, Chinese entrepreneurs and their Afghan intermediaries described a frenzy reminiscent of a 19th-century gold rush. Globe-trotting Chinese traders packed into Kabul’s hotels, racing to source lithium in the hinterlands. Chinese executives filed into meetings with Taliban leaders, angling for exploration rights. In January, Taliban officials arrested a Chinese businessman for allegedly smuggling 1,000 tons of lithium ore from Konar province to China via Pakistan.