- Joined

- Jan 5, 2010

- Messages

- 2,106

- Points

- 83

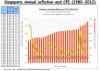

Money printing (/borrowing) by Singapore government- how much is too much?

Briefly, M1= printed SGD in circulation + some more, M3= quasi money= everything including government bonds (treasuries) etc (people will pay U money for these at whatever is market rate(much is sold to CPF so Temasek & GIC can invest the CPF monies etc) but too big to use at super-mart).

dollar notes created/ printed have increased from SGD71.0 billion (1989) to SGD 451.7 billion (2011)

Using compound interest(inflation) calculator [ink] with the input values as:

Input principle: $71,007.8 B

Input years= 22yrs.

Input total= $451,675.2 B

Result: Effective Annual Rate of increase = 8.7736% P.a.

The same calculation for years 2010 to 2011 period= Effective Annual Rate of increase= 10.135%

Thus if Singapore's GDP didn't increase by 10.135%, why is the government of Singapore issuing so many treasuries/ printing so much $$$???

In short, the government of Singapore should perhaps encourage its citizens to buy gold rather than pouring their $$$ into housing to avoid a large housing bubble and then the political instability following either such a bubble bursting or else the ravages of high inflation rates upon society that few governments can effectively control albeit postpone (which is what Paul Volcker, I think, did)

.JPG) [pict source: https://secure.mas.gov.sg/msb-xml/Re...=I&tableID=I.1 ]

[pict source: https://secure.mas.gov.sg/msb-xml/Re...=I&tableID=I.1 ]

Caption: Currency to exchange for gold please- takers, anyone?[Image source]

Caption: Currency to exchange for gold please- takers, anyone?[Image source]

Briefly, M1= printed SGD in circulation + some more, M3= quasi money= everything including government bonds (treasuries) etc (people will pay U money for these at whatever is market rate(much is sold to CPF so Temasek & GIC can invest the CPF monies etc) but too big to use at super-mart).

- Will so much printed money worsen the rate of inflation (even if it isn't captured by the CPI) in Singapore? ('Why CPI might fail to capture the true rate of Inflation in Singapore.'[HWZ, 11Jan2013])

- Will so much money 'printing' worsen the wealth divide?

- Will the supply inflation of the SGD ($ printing) also inflate the housing price in Singapore?

- Are CPI measurements in Singapore consistent over the years just as the luxuries enjoyed by the average Singaporean (who has been forced to become more and more 'productive') have alongside increased- is this 'productivity' readily translatable into quality of life improvements?

- What is the effect of Singapore's increase in GDP upon the environment- Singapore has already refused entry to boat people arriving as political refugees 'Singapore cannot accept Rohingya refugees' [CNA, 24Mar2009], will Singapore do the same for environmental refugees as sea levels across the world rise?

dollar notes created/ printed have increased from SGD71.0 billion (1989) to SGD 451.7 billion (2011)

Using compound interest(inflation) calculator [ink] with the input values as:

Input principle: $71,007.8 B

Input years= 22yrs.

Input total= $451,675.2 B

Result: Effective Annual Rate of increase = 8.7736% P.a.

The same calculation for years 2010 to 2011 period= Effective Annual Rate of increase= 10.135%

Thus if Singapore's GDP didn't increase by 10.135%, why is the government of Singapore issuing so many treasuries/ printing so much $$$???

In short, the government of Singapore should perhaps encourage its citizens to buy gold rather than pouring their $$$ into housing to avoid a large housing bubble and then the political instability following either such a bubble bursting or else the ravages of high inflation rates upon society that few governments can effectively control albeit postpone (which is what Paul Volcker, I think, did)

Last edited:

I prefer to read a book in order to get the whole picture.

I prefer to read a book in order to get the whole picture.