- Joined

- Aug 20, 2022

- Messages

- 17,944

- Points

- 113

Mother and son jailed for lying to Iras in first prosecution of ‘99-to-1’ property purchase scheme

Ng Chiew Yen and her son Keith Tan Kai Wen arriving at the State Courts on Sept 20, 2024.ST PHOTO: KELVIN CHNG

Andrew Wong

UPDATED FEB 28, 2025, 10:07 PM

SINGAPORE – A mother and son pair formulated a plan to try and abuse a loophole to avoid paying a hefty sum in stamp duty for a condominium apartment.

When auditors from the tax office came knocking, the pair doubled down on their lies by providing false information to the officers.

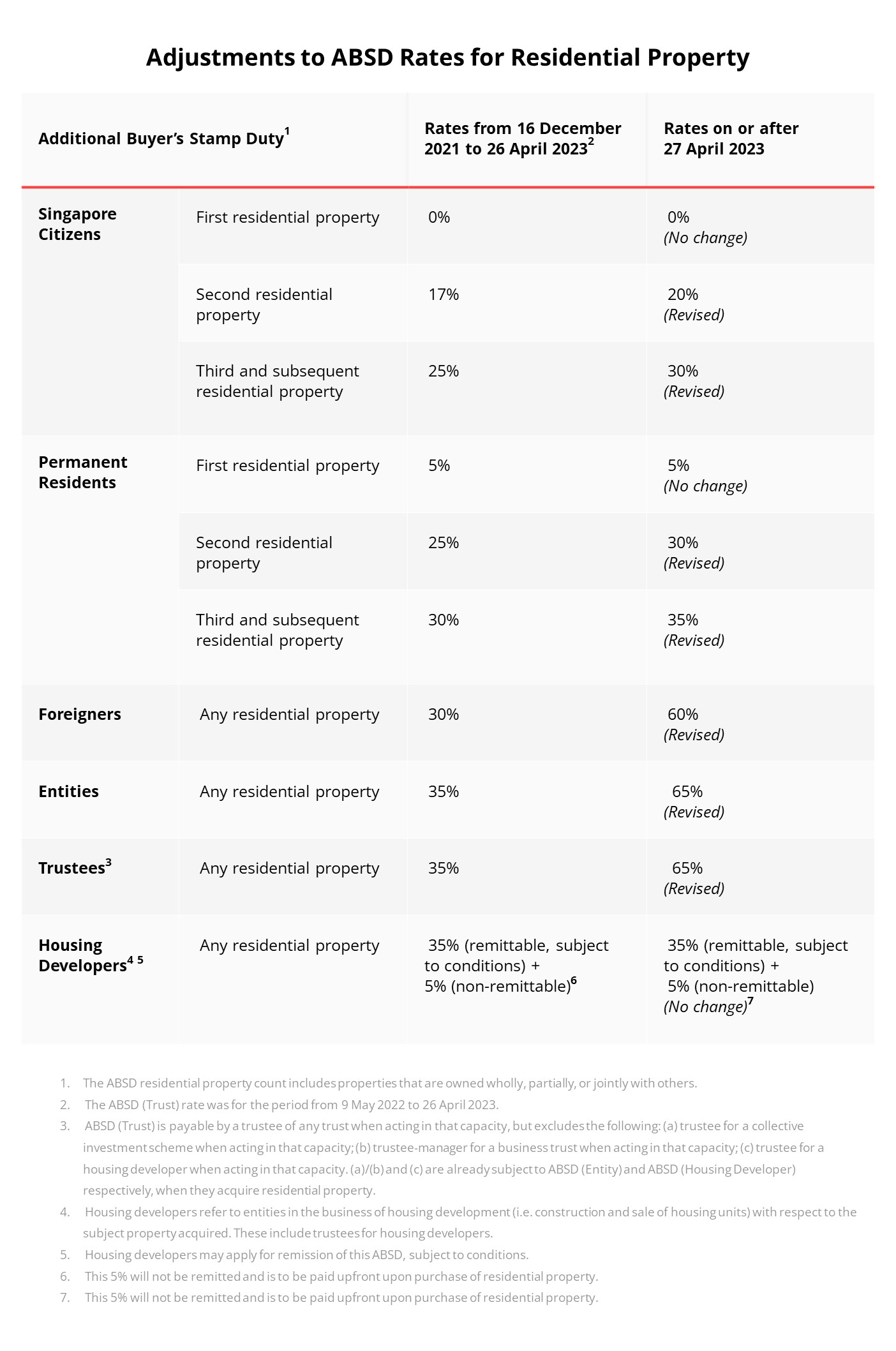

They also deleted messages exchanged on their smartphones that contained their plan from the outset, which was to avoid paying the additional buyer’s stamp duty (ABSD).

On Feb 28, the mother, Ng Chiew Yen, 56, and her son, Keith Tan Kai Wen, 26, each pleaded guilty to two charges of providing false and misleading information to the taxman.

They were both sentenced to two weeks’ jail.

This is the first prosecution involving an Inland Revenue Authority of Singapore (Iras) audit into a “99-to-1” purchase arrangement.

This scheme has been used by some property buyers to reduce the rightful ABSD payable on the purchase of a residential property.