Food, transport, preschool and healthcare costs may go up in 2022: MAS

- Prices of various goods and services are expected to rise in 2022

- This is because of higher costs of imported products, as well as higher labour costs for companies

- Economists said there is a need to monitor inflation due to concerns that it may spiral

More labour costs, in the form of wage growth, would also push business costs up, which would also be passed through in the form of consumer prices.

The Monetary Authority of Singapore (MAS) expects overall inflation for next year to come in between 1.5 and 2.5 per cent, up from around the projected 2 per cent in 2021.

Core inflation, which strips out private transport and accommodation costs, is projected to rise between 1 and 2 per cent next year, MAS said in its bi-annual macroeconomic review released on Thursday (Oct 28). This is higher than the upper end of the 0 to 1 per cent forecast range that it expects inflation to hit this year.

This is a rebound from earlier lows, which saw overall inflation slip into negative territory at the onset of the global pandemic early last year.

Explainer: What online shoppers need to know about GST for low-value imported items and non-digital services

While a rising inflation typically follows a recovering economy, economists are concerned that there may be concerns of inflation overshoot next year.

Senior economist Irvin Seah from DBS bank said that inflation will be the top risk to growth next year and it has to be watched very closely.

For one, the factors driving up prices are not solely based on strong growth, but also supply-side constraints such as border restrictions and supply chain disruptions.

Ms Selena Ling, head of treasury and research at OCBC bank, said that a multitude of other factors including higher global energy and food prices, tight foreign manpower policy and an ageing population would mean that there is a need to be wary of a potential wage-price spiral.

“So both businesses and consumers may have to grapple with higher and persistent inflation.”

Mr Seah noted that the resident unemployment rate is still higher than pre-pandemic levels, so there are many middle-age workers who have not yet found jobs but may have to contend with rising prices in the coming year.

GST hike can’t be deferred indefinitely: DPM Heng

“Consumer purchasing power will definitely be eroded,” he said.

The central bank has tried to pre-empt this by tightening monetary policy in its October review to buffer some imported inflation. If it continues to tighten its policy review in April next year, and core inflation still has not subsided by the end of next year, Ms Ling said that MAS may be in a bind.

There may be further pain points if the Government introduced the 2 percentage point hike for the Goods and Services Tax (GST), put forth a wealth tax or raised the carbon tax during the Budget next year, Ms Ling added.

Mr Seah said there is a high possibility that the GST will be introduced next year, which will be “rubbing salt in the wound,” given the wider inflationary pressures.

SOURCES OF INFLATION FOR 2022

1. Labour costs

Fares have to rise, operators must be more cost-efficient as taxpayers’ bill ‘cannot keep ballooning’: Ong Ye Kung

As government support measures taper off, MAS said that business cost pressures should pick up next year.

With wage growth likely to remain firm, the unit labour cost in the services sector would rise to pre-pandemic levels by the end of the year.

“These stronger labour cost pressures are expected to drive a pickup in inflation in most core consumer price index (CPI) components in 2022, with a greater impact on discretionary services, including food services,” it added.

2. Administrative services

MAS expects fee increases to resume next year as Singapore’s economy returns to a firmer footing.

Public transport fees could be raised, and the effect of slowing down price increases due to a fee cap on preschool education should fade.

Room to review wealth taxes but Singapore must still remain attractive to those who work hard: DPM Heng

Childcare centres or preschools under a government-funded scheme have to adhere to fee caps before GST, to ensure it is kept affordable for parents of Singaporean children.

Existing outpatient subsidies under the Public Health Preparedness Clinic scheme could also be phased out, depending on the Covid-19 situation.

3. Disruptions to global food production and consumer goods supply chain

MAS said that these disruptions would take some time to resolve as Covid-19 containment measures in other countries would likely remain in place until their vaccination rates rise.

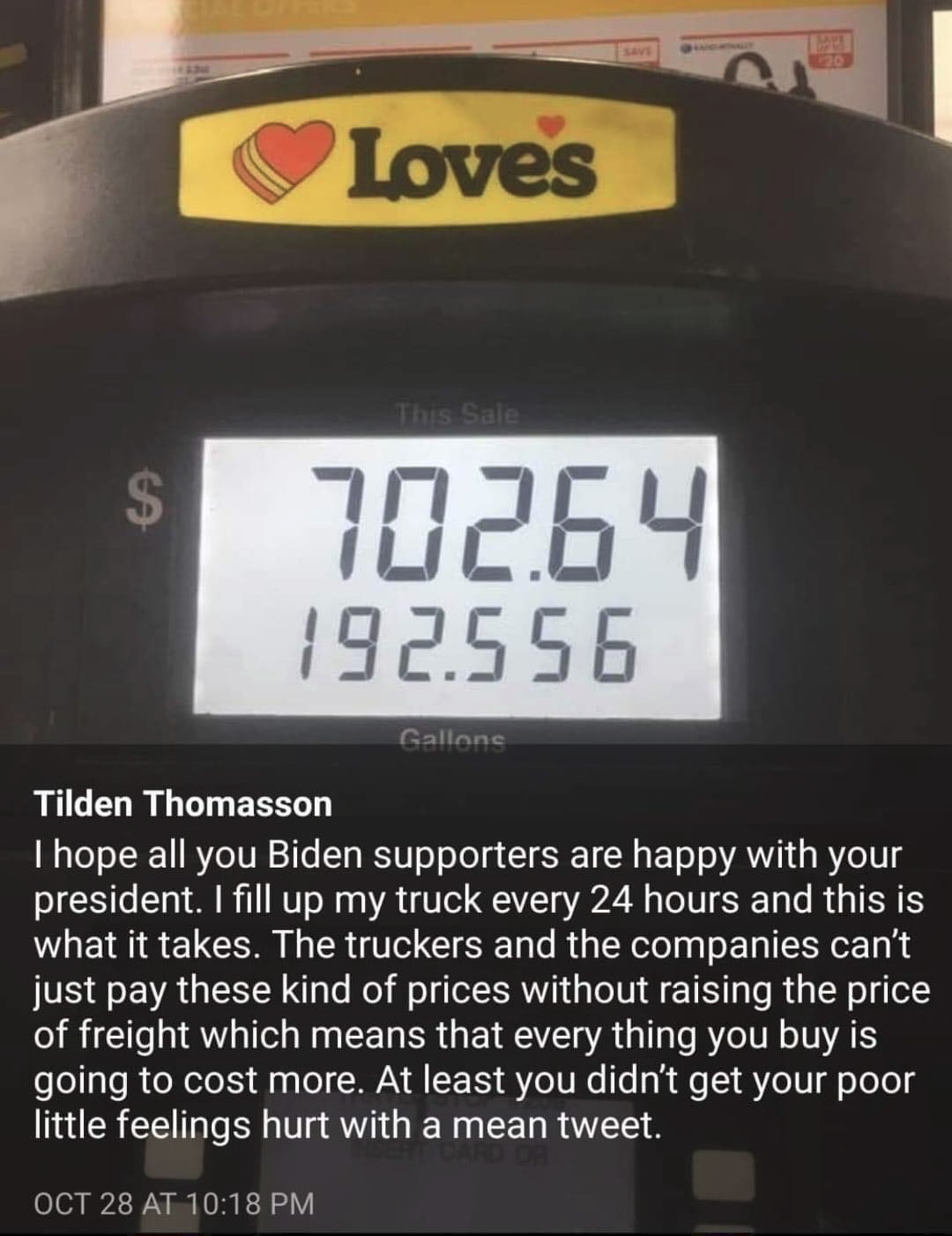

Higher material costs, as well as freight and delivery costs, which have been eating into companies’ profit margins, could be passed on to consumers.

For example, semiconductor chip shortages that are expected to last for another year could lead to prices of consumer electronic products remaining firm.

Even though global inflation has slowed, supply chain problems and a logistics crunch would mean that imported food prices in Singapore are expected to increase.

4. Global energy prices

As oil prices are likely to remain at similar levels next year, MAS said the contribution of energy-related cost items to inflation should decline in 2022.

There remain risks, however, given the recent surge in gas prices. If the price increase persists, it could contribute to stronger-than-expected increase in oil prices