https://finance.yahoo.com/news/china-not-blame-african-debt-093000144.html

China 'not to blame' for African debt crisis, it's the West: study

Tue, July 12, 2022, 5:30 PM·5 min read

African countries owe three times more debt to Western banks, asset managers and oil traders than to China, and are charged double the interest, according to a study released on Monday by British campaign charity Debt Justice.

This is despite the growing accusations by the US and other Western countries that China's lending is behind the debt troubles faced by some African countries.

The study said just 12 per cent of the continent's external debt was owed to Chinese lenders, compared to 35 per cent owed to Western private creditors, according to calculations based on World Bank data.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

Interest rates charged on private loans were almost double those on Chinese loans, while the most indebted countries were less likely to have their debt dominated by China, the study found. The average interest rate on private sector loans is 5 per cent, compared to 2.7 per cent on loans from Chinese public and private lenders.

The study was released ahead of the G20 finance ministers meeting from July 15-16 in Indonesia. Campaigners are calling on Western countries, particularly Britain and the US, to compel private lenders to take part in the Common Framework - the G20's latest debt relief scheme.

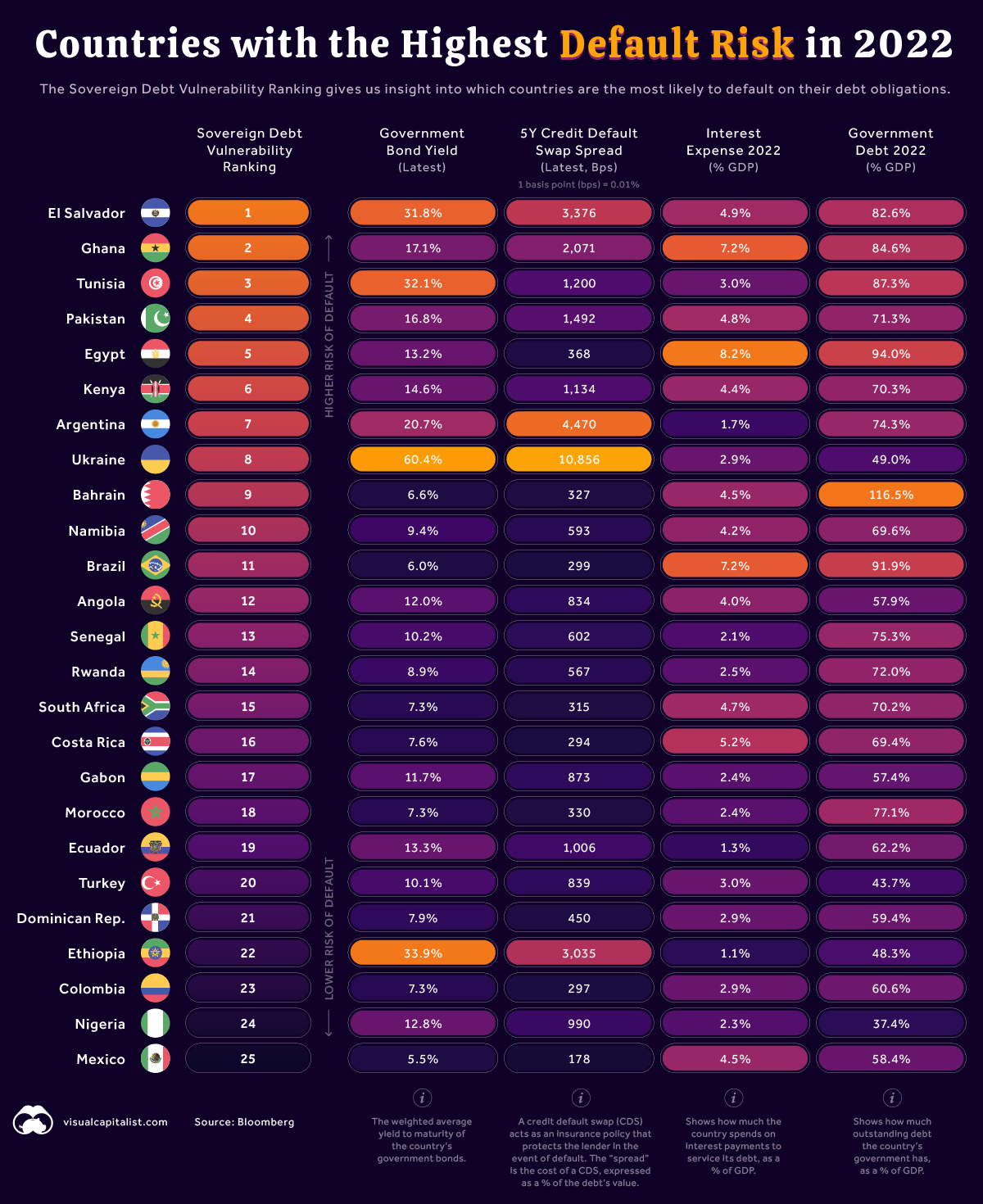

The study found a dozen of the 22 African countries with the highest debts were paying more than 30 per cent of their total external repayments to private lenders. These included Cabo Verde, Chad, Egypt, Gabon, Malawi, Morocco, Rwanda, Senegal, Tunisia and Zambia.

South Sudan is one of the hardest hit in this category, with 81 per cent of its debt repayments going to private creditors, and just 11 per cent to China. Ghana is also paying more than half of its external debt obligations to the private sector, with 11 per cent going to China and the rest to multilateral lenders and other governments.

Chinese lenders accounted for more than 30 per cent of loan payments in six of the 22 most indebted countries - Angola, Cameroon, Republic of the Congo, Djibouti, Ethiopia and Zambia.

The study calculations showed 59 per cent of Angola's foreign debt payments serviced Chinese lenders. And Djibouti - where China has poured billions of dollars into building ports and free trade zones, and also set up its first overseas military base - makes 64 per cent of its external debt payments to Beijing.

Debt Justice policy head Tim Jones said Western leaders blamed China for debt crises in Africa, "but this is a distraction".

"The truth is their own banks, asset managers and oil traders are far more responsible but the G7 are letting them off the hook."

Jones said China had taken part in the G20's Debt Service Suspension Initiative during the pandemic, while private lenders did not. "There can be no effective debt solution without the involvement of private lenders. The UK and US should introduce legislation to compel private lenders to take part in debt relief," he said.

The G20 initiative, unveiled in May 2020, provided 48 economies with temporary cash-flow relief, delivering about US$12.9 billion in debt service payments by the end of December when it ended.

But the exclusion of private and multilateral lenders meant countries that applied to take part in the initiative saw just 23 per cent of their external repayments suspended.

In 2020, Zambia became the first African country to default - on US$3 billion in dollar-denominated bonds - in the pandemic era. It is now in the process of restructuring about US$17 billion in external debt as a precondition to securing IMF loans of US$1.4 billion.

Lusaka owes Chinese lenders about US$6 billion, which has gone into building mega projects including airports, highways and power dams.

The initiative's replacement, the G20 Common Framework, allows participating countries to agree to restructure debt with bilateral lenders and the International Monetary Fund (IMF). The nations are then supposed to seek similar debt treatment from private sector creditors.

Only Chad, Zambia and Ethiopia have so far applied for help through the Common Framework, but all are still waiting for debt relief.

The G7 countries have blamed China for the failure of the debt relief programme to help heavily indebted countries avoid default, doubling down in May with a statement from the finance ministers of the world's seven most advanced economies.

"With regards to the implementation of the Common Framework, it remains essential that all relevant creditor countries - including non-Paris Club countries, such as those like China, with large outstanding claims on low-income countries facing debt sustainability challenges - contribute constructively to the necessary debt treatments as requested," they said.

Yungong Theo Jong, head of programmes at the African Forum and Network on Debt and Development (Afrodad), said multilateral and private lenders remained the biggest creditors to African governments.

"Loans from China have increased Africa's indebtedness, but by far less than Western lenders. All lenders must participate in debt relief. Western governments must lead the way by making private lenders cancel debts," he said.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP's Facebook and Twitter pages. Copyright © 2022 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2022. South China Morning Post Publishers Ltd. All rights reserved.