- Joined

- Jul 11, 2008

- Messages

- 5,769

- Points

- 48

Monday, October 13, 2008

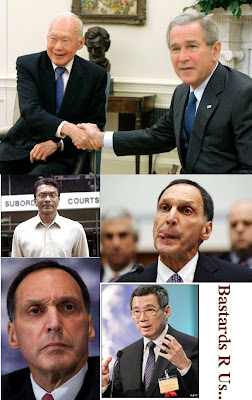

<!-- Begin .post --> Greed: Lehman Bro; NKF & famiLEE LEEgime's CEO minsiters

Bush might be the poorest bastard among these greedy faces in terms of salaries:

Ask yourself what are the differences between famiLEE LEEgime's CEO ministers & NKF's TT Durai & Lehman Brother's Richard Fuld? Aren't they all CEOs of the world's highest salaries?

NKF is just a charity implementation of famiLEE LEEgime's CEO minister culture & other LEEgalized Corruption systems. Lehman Brother's type of syndicates of greed is exactly what they are modeled after.

Greedy Selfish Ruthless Exploiters they are.

They control huge funds and used that as their false justifications for highest salaries and then defended their own greed with all the same theories.

TT Durai exploited NKF charity donations while his NKF patients are neglected and suffering. Richard Fuld exploited Lehman Brother's investors' funds and enriched himself ruthlessly as he vaporised his victims' funds. LKy's famiLEE LEEgime is the worst of all, in that they manipulate entire parliament and made laws to LEEgalize their own corruptions and draw salaries more than 5 times of Bush's and enslave entire nation's peasants for life-long exploitations.

Bush vaporized all the remaining strengths of superpower USA while his family & cronies of Texas oil merchants including Cheney enriched themselves.

ABC News Richard Fuld salary & bonus article

<!-- Begin .post --> Greed: Lehman Bro; NKF & famiLEE LEEgime's CEO minsiters

Bush might be the poorest bastard among these greedy faces in terms of salaries:

Ask yourself what are the differences between famiLEE LEEgime's CEO ministers & NKF's TT Durai & Lehman Brother's Richard Fuld? Aren't they all CEOs of the world's highest salaries?

NKF is just a charity implementation of famiLEE LEEgime's CEO minister culture & other LEEgalized Corruption systems. Lehman Brother's type of syndicates of greed is exactly what they are modeled after.

Greedy Selfish Ruthless Exploiters they are.

They control huge funds and used that as their false justifications for highest salaries and then defended their own greed with all the same theories.

TT Durai exploited NKF charity donations while his NKF patients are neglected and suffering. Richard Fuld exploited Lehman Brother's investors' funds and enriched himself ruthlessly as he vaporised his victims' funds. LKy's famiLEE LEEgime is the worst of all, in that they manipulate entire parliament and made laws to LEEgalize their own corruptions and draw salaries more than 5 times of Bush's and enslave entire nation's peasants for life-long exploitations.

Bush vaporized all the remaining strengths of superpower USA while his family & cronies of Texas oil merchants including Cheney enriched themselves.

ABC News Richard Fuld salary & bonus article

Lehman Brothers Boss Defends $484 Million in Salary, Bonus

Richard Fuld Becomes Poster Boy for Wall Street Greed at Heated Congressional Hearing

By BRIAN ROSS and ALICE GOMSTYN

October 6, 2008

Richard Fuld Becomes Poster Boy for Wall Street Greed at Heated Congressional Hearing

By BRIAN ROSS and ALICE GOMSTYN

October 6, 2008