- Joined

- Jul 11, 2008

- Messages

- 5,769

- Points

- 48

Sunday, October 12, 2008

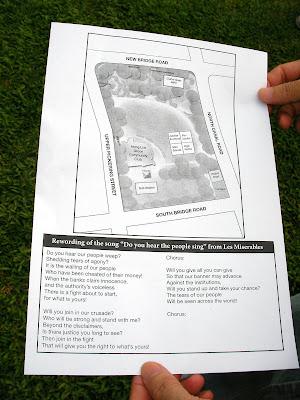

<!-- Begin .post --> Thousand unhappy Peasants gathered at Speakers' Corner Saturday evening

I must state that I only support peasants aggrieved by irresponsible adverts and lured by lucrative investment offers and misled into losses with naive mindsets, to voice up against these financial institutions, and bring awareness to public.

I am not supportive to calls for using public funds to bail-out any losses. I think this is most unfair because these losses are incurred by those who stood for financial gain with risks, this is their own gamble and their own consequences. They got gains and losses this is what they went in for. The public does not - not at all share their gains, and therefore should not be sharing their losses. These gamblers are not much more different from Casino gamblers, when they win they enjoy their profits without sharing with the public at all, they earned vacations; new cars; new houses etc all for themselves and not the public. When they lost no public funds should be abused to bail them out, they must learn from their own lessons and face their own consequences just as how they enjoyed their gains.

Public funds should not be used to bail out stock losers, just as public funds are not to be abused to bail out casino losers. Not even in the name of saving the economy. The member of public who did not took part in these gamble stand to gain nothing, and thus should not lose anything on behalf of these greed driven losers. The more you rescue these losers the more emboldened they got to take risk on behalf of the public, and the less they will learn from their lessons.

By the law of nature the losers are supposed to bear the consequences themselves without affecting other innocents who did not made any decision to take risk. Government should hold these innocent members of public entirely harmless instead of abusing funds from these innocent members of public to cover losses made by some who on their own decisions took risks to stand for personal gains without any benefit to the public.

When Temasek GIC made their huge losses it is already bonded unfairly by Singaporean tax payers, why must tax payers still further bear losses beyond the incompetence of famiLEE LEEgime / Temasek GIC?

Tax payers should stand up NOW and refuse to be suckers all the way!

posted by uncleyap at 1:33 AM

<!-- Begin .post --> Thousand unhappy Peasants gathered at Speakers' Corner Saturday evening

I must state that I only support peasants aggrieved by irresponsible adverts and lured by lucrative investment offers and misled into losses with naive mindsets, to voice up against these financial institutions, and bring awareness to public.

I am not supportive to calls for using public funds to bail-out any losses. I think this is most unfair because these losses are incurred by those who stood for financial gain with risks, this is their own gamble and their own consequences. They got gains and losses this is what they went in for. The public does not - not at all share their gains, and therefore should not be sharing their losses. These gamblers are not much more different from Casino gamblers, when they win they enjoy their profits without sharing with the public at all, they earned vacations; new cars; new houses etc all for themselves and not the public. When they lost no public funds should be abused to bail them out, they must learn from their own lessons and face their own consequences just as how they enjoyed their gains.

Public funds should not be used to bail out stock losers, just as public funds are not to be abused to bail out casino losers. Not even in the name of saving the economy. The member of public who did not took part in these gamble stand to gain nothing, and thus should not lose anything on behalf of these greed driven losers. The more you rescue these losers the more emboldened they got to take risk on behalf of the public, and the less they will learn from their lessons.

By the law of nature the losers are supposed to bear the consequences themselves without affecting other innocents who did not made any decision to take risk. Government should hold these innocent members of public entirely harmless instead of abusing funds from these innocent members of public to cover losses made by some who on their own decisions took risks to stand for personal gains without any benefit to the public.

When Temasek GIC made their huge losses it is already bonded unfairly by Singaporean tax payers, why must tax payers still further bear losses beyond the incompetence of famiLEE LEEgime / Temasek GIC?

Tax payers should stand up NOW and refuse to be suckers all the way!

posted by uncleyap at 1:33 AM

Last edited:

THEY SIT THEIR LAME ASS IN BIG COMFORTABLE OFFICES TO COLLECT HUGE SALARIES ONLY!

THEY SIT THEIR LAME ASS IN BIG COMFORTABLE OFFICES TO COLLECT HUGE SALARIES ONLY!