- Joined

- Jan 5, 2010

- Messages

- 2,086

- Points

- 83

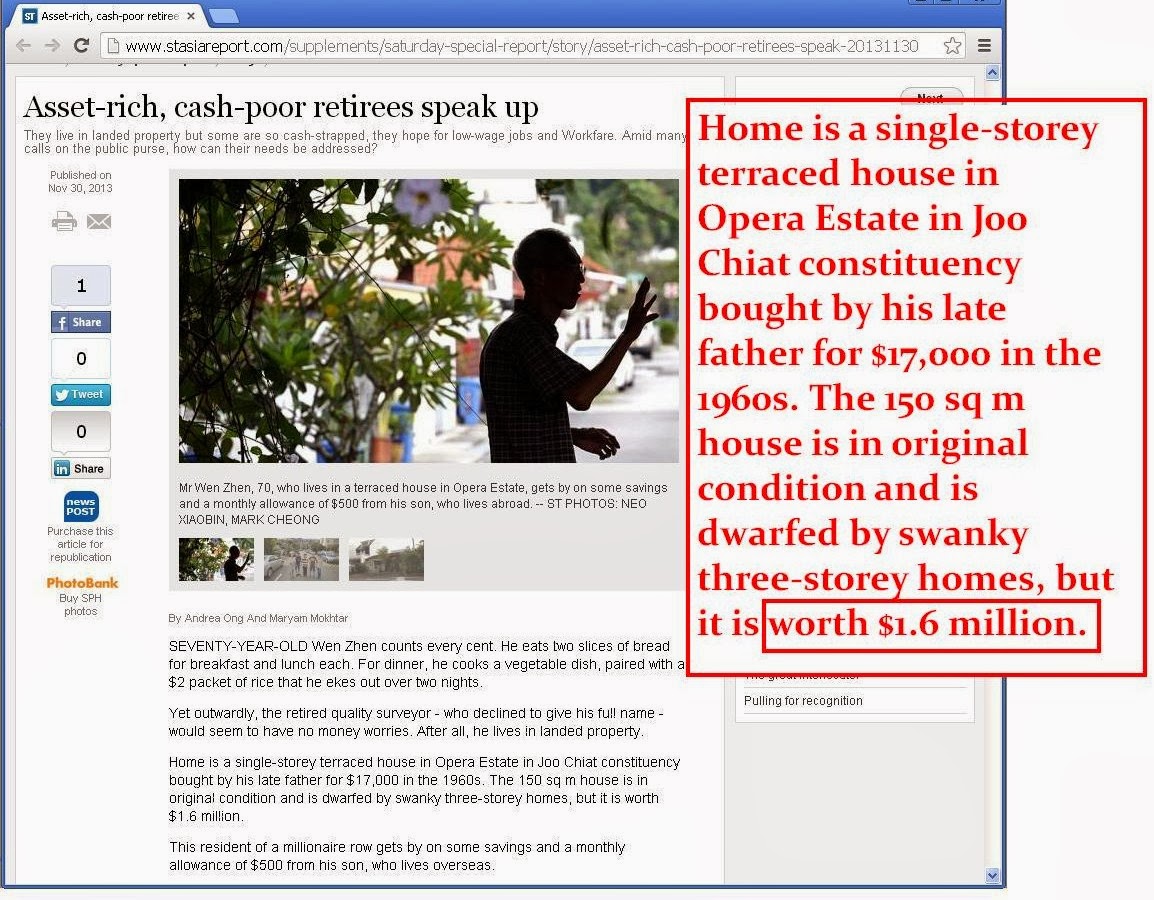

With Reverse Mortgage facilities dime a dozen, Asset-rich Singaporeans should stop badgering the government for handouts and free gifts.

References as appended:

- Reverse mortgage - Wikipedia, the free encyclopedia

- List of banks in Singapore - Wikipedia, the free encyclopedia

- ST,05Dec2013: 'A question of fairness'

Pls note that there are "at present, 111 commercial banks" in Singapore, so commercial banks can handle the reverse mortgage of private properties and the CPF can handle the reverse mortgage of HDB properties (all sizes); only when the per capita home equity of a person should fall below say SGD50K should a person be granted be granted full medifund subsidies (sans congenital illness that is)- this of course is just a ball park suggestion, other suggestions should equally be considered.

Living in a private residential property in Singapore is undeniably a luxury, and now that the government budget is short "..to pay for the slew of healthcare, housing and infrastructure initiatives announced by Prime Minister Lee... A more probable ... for us to increase GST from the current 7 per cent to 10 per cent." ('GST hike ‘more likely’ if Govt needs to raise revenue for new initiatives'), we all know that GST is a regressive tax since it hits the poor more than the rich, so asset rich Singaporeans shouldn't expect the government to subsidize their necessities just so that they can enjoy their daily extravagance(big landed properties in land scarce Singapore).

.JPG) [IMG URL][Full Text URL]

[IMG URL][Full Text URL]

.JPG) [IMG URL]

[IMG URL]

Tags:

Retirement, Annuity, assets, equity, Singapore, financial, banking, mortgage, prudence, welfare, GST, CPF, reverse,poverty, gini, governance, planning,

References as appended:

- Reverse mortgage - Wikipedia, the free encyclopedia

- List of banks in Singapore - Wikipedia, the free encyclopedia

- ST,05Dec2013: 'A question of fairness'

Pls note that there are "at present, 111 commercial banks" in Singapore, so commercial banks can handle the reverse mortgage of private properties and the CPF can handle the reverse mortgage of HDB properties (all sizes); only when the per capita home equity of a person should fall below say SGD50K should a person be granted be granted full medifund subsidies (sans congenital illness that is)- this of course is just a ball park suggestion, other suggestions should equally be considered.

Living in a private residential property in Singapore is undeniably a luxury, and now that the government budget is short "..to pay for the slew of healthcare, housing and infrastructure initiatives announced by Prime Minister Lee... A more probable ... for us to increase GST from the current 7 per cent to 10 per cent." ('GST hike ‘more likely’ if Govt needs to raise revenue for new initiatives'), we all know that GST is a regressive tax since it hits the poor more than the rich, so asset rich Singaporeans shouldn't expect the government to subsidize their necessities just so that they can enjoy their daily extravagance(big landed properties in land scarce Singapore).

Reverse mortgage

A reverse mortgage, also referred to as a Home Equity Conversion Loan, is a financial instrument that allows seniors to access the equity in their home without income or credit qualifications. Seniors must be a minimum age (country-specific), live in their own home, and have equity in it. The important distinction between a reverse mortgage and a conventional mortgage is that there are no principal or interest payments required on the home while the borrower occupies the property. In the case of two borrowers being on title, should one permanently leave the property due to a death or hospitalization, the other borrower continues to remain in the home. Repayment is only required if the borrower sells the home, or moves out of the property for more than 365 consecutive days.

In a conventional mortgage, the homeowner makes a monthly amortized payment to the lender; after each payment the equity increases by the amount of the principal included in the payment, and when the mortgage has been paid in full, the property is released from the mortgage. In a reverse mortgage, the home owner is under no obligation to make payments, but is free to do so with no pre-payment penalties. The line of credit portion operates like arevolving credit line, so a payment in reduction of a line of credit increases the available credit by the same amount. Interest that accrues is added to the mortgage balance. ... ...

Reverse mortgage - Wikipedia, the free encyclopedia

List of banks in Singapore

This is a list of banks with operations in Singapore. Location of incorporation is provided in brackets for foreign banks. There are, at present, 111commercial banks, 49 merchant banks, and 45 banks with representative offices in Singapore.

List of banks in Singapore - Wikipedia, the free encyclopedia

The Straits Times, Published on Dec 05, 2013

A question of fairness

I AM a 66-year-old retiree living in a condominium unit worth about $1.35 million. I have never forgotten that the appreciation in value of my home was possible only because of good government policies and planning.

If I should need cash one day, I will sell my condo unit and downgrade to a three-room HDB flat.

Some retirees living in private landed properties worth millions of dollars are expecting the Government to give them financial assistance so they can continue living in their homes, which they intend to leave to their children when they die.

Is it fair for them to have their cake and eat it, too? Do they not know that they are the envy of thousands of retirees living in rented one- and two-room flats?

Is it fair or even wise of them to vote irresponsibly because they are envious of the help given to these asset-poor, cash-poor retirees, who have also contributed to the success of Singapore and deserve much more help?

Lee Hong Leong

Copyright © 2013 Singapore Press Holdings. All rights reserved.

A question of fairness

Tags:

Retirement, Annuity, assets, equity, Singapore, financial, banking, mortgage, prudence, welfare, GST, CPF, reverse,poverty, gini, governance, planning,

Last edited: