-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Property agents feeling the pinch as market cools

- Thread starter nutbush

- Start date

And what is her 'the other job' when her property business ain't doing so good? LoLoLoLoL

And what is her 'the other job' when her property business ain't doing so good? LoLoLoLoL

Should be a capable lady

according to the enclosed article, she is going to "disrupt the property listing space".

Game plan

PropSocial competes not only against older players such as iProperty, PropertyGuru and StarProperty, but also relative newcomers such as TheEdgeProperty, DurianProperty, MyProperty, Brickz.my and Estate123, to name just a few. The regional space is just as crowded. While PropSocial touts its buyer focus, Singapore’s 99.co and Thailand’s FazWaz do the same, as does Malaysia’s own Brickz.my.

While Prop Community the company was established in May last year, the PropSocial portal was operational only last December. So far, Tan is pleased with progress, claiming some 2,400 registered users on the portal. “We hope that over the next two years, we can have at least 200,000 registered users on our portal,” she says.

Not a newbie

Although Tan is only in her early 30s, she has some experience driving a property portal startup. She was previously the general manager of property portal Propwall, which was acquired by The Star Media Group, then known as Star Publications, in 2013. The Star bought Propwall, along with two other online portals, for RM13.5 million (US$3.7 million at current rates).

Prices of completed apartments, condos in Singapore down 0.1% in April: NUS index

http://www.businesstimes.com.sg/rea...ondos-in-singapore-down-01-in-april-nus-index

http://www.businesstimes.com.sg/rea...ondos-in-singapore-down-01-in-april-nus-index

Is she a malaysian? If she is, a foreign talent indeed.

Should be a capable lady

according to the enclosed article, she is going to "disrupt the property listing space".

Game plan

PropSocial competes not only against older players such as iProperty, PropertyGuru and StarProperty, but also relative newcomers such as TheEdgeProperty, DurianProperty, MyProperty, Brickz.my and Estate123, to name just a few. The regional space is just as crowded. While PropSocial touts its buyer focus, Singapore’s 99.co and Thailand’s FazWaz do the same, as does Malaysia’s own Brickz.my.

While Prop Community the company was established in May last year, the PropSocial portal was operational only last December. So far, Tan is pleased with progress, claiming some 2,400 registered users on the portal. “We hope that over the next two years, we can have at least 200,000 registered users on our portal,” she says.

Not a newbie

Although Tan is only in her early 30s, she has some experience driving a property portal startup. She was previously the general manager of property portal Propwall, which was acquired by The Star Media Group, then known as Star Publications, in 2013. The Star bought Propwall, along with two other online portals, for RM13.5 million (US$3.7 million at current rates).

Is she a malaysian? If she is, a foreign talent indeed.

And not here, confirmed foreign talent.

Should be a capable lady

according to the enclosed article, she is going to "disrupt the property listing space".

Game plan

PropSocial competes not only against older players such as iProperty, PropertyGuru and StarProperty, but also relative newcomers such as TheEdgeProperty, DurianProperty, MyProperty, Brickz.my and Estate123, to name just a few. The regional space is just as crowded. While PropSocial touts its buyer focus, Singapore’s 99.co and Thailand’s FazWaz do the same, as does Malaysia’s own Brickz.my.

While Prop Community the company was established in May last year, the PropSocial portal was operational only last December. So far, Tan is pleased with progress, claiming some 2,400 registered users on the portal. “We hope that over the next two years, we can have at least 200,000 registered users on our portal,” she says.

Not a newbie

Although Tan is only in her early 30s, she has some experience driving a property portal startup. She was previously the general manager of property portal Propwall, which was acquired by The Star Media Group, then known as Star Publications, in 2013. The Star bought Propwall, along with two other online portals, for RM13.5 million (US$3.7 million at current rates).

Capable? Offering more options besides the usual COB, CIM or even RAW to those who could boost her career and social standing?

Seen it all. Greed and ambition are dangerous combination that when combined, all hell breaks loose! LoL

We all have our dreams........

Record deal nets 26-year-old property agent $1.5m

http://www.straitstimes.com/news/si...-nets-26-year-old-property-agent-15m-20150529

Record deal nets 26-year-old property agent $1.5m

http://www.straitstimes.com/news/si...-nets-26-year-old-property-agent-15m-20150529

i don't think it's that easy, she probably sell her sob story to the rich client that her father is sick and so on, out of pity, the good hearted client let her deal the property transaction for him.

We all have our dreams........

Record deal nets 26-year-old property agent $1.5m

http://www.straitstimes.com/news/si...-nets-26-year-old-property-agent-15m-20150529

i don't think it's that easy, she probably sell her sob story to the rich client that her father is sick and so on, out of pity, the good hearted client let her deal the property transaction for him.

Decent income, i still salute her.

Of course, she dun take all of the 1.5m commission, gotta share with agency and pay income tax.

I hope she will not squander her money into speculative investments.

sales people have no dignity...selling your service is insufficient nowadays, you must have good PR and most importantly, your network. acting pathetic is a crucial skill for some.

Decent income, i still salute her.

Of course, she dun take all of the 1.5m commission, gotta share with agency and pay income tax.

I hope she will not squander her money into speculative investments.

sales people have no dignity...selling your service is insufficient nowadays, you must have good PR and most importantly, your network. acting pathetic is a crucial skill for some.

For her age, i don't think she is so seasoned.

Maybe she is just more blessed n luckier.

All the best for the young millionaire.

Good articles: http://www.srx.com.sg/research

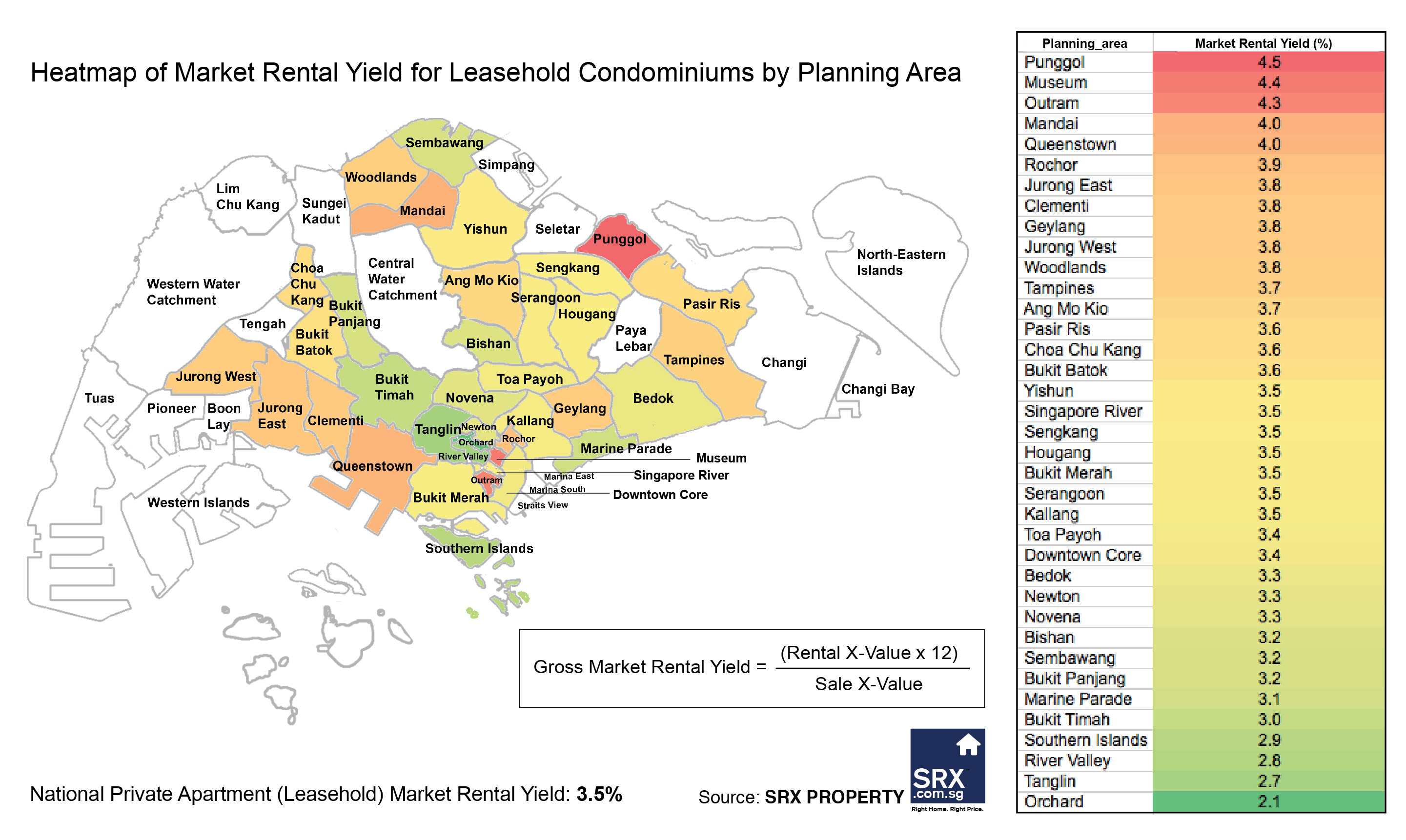

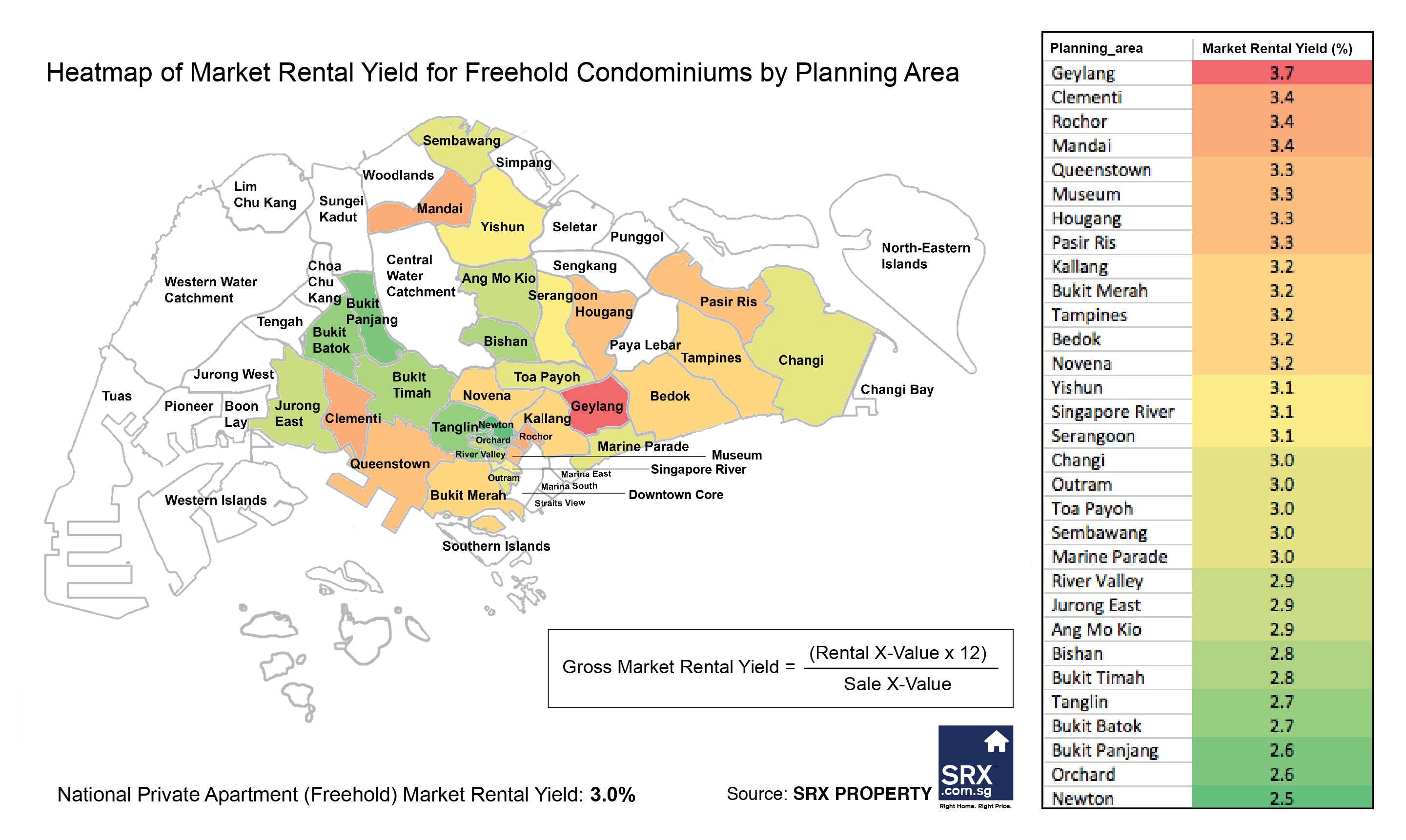

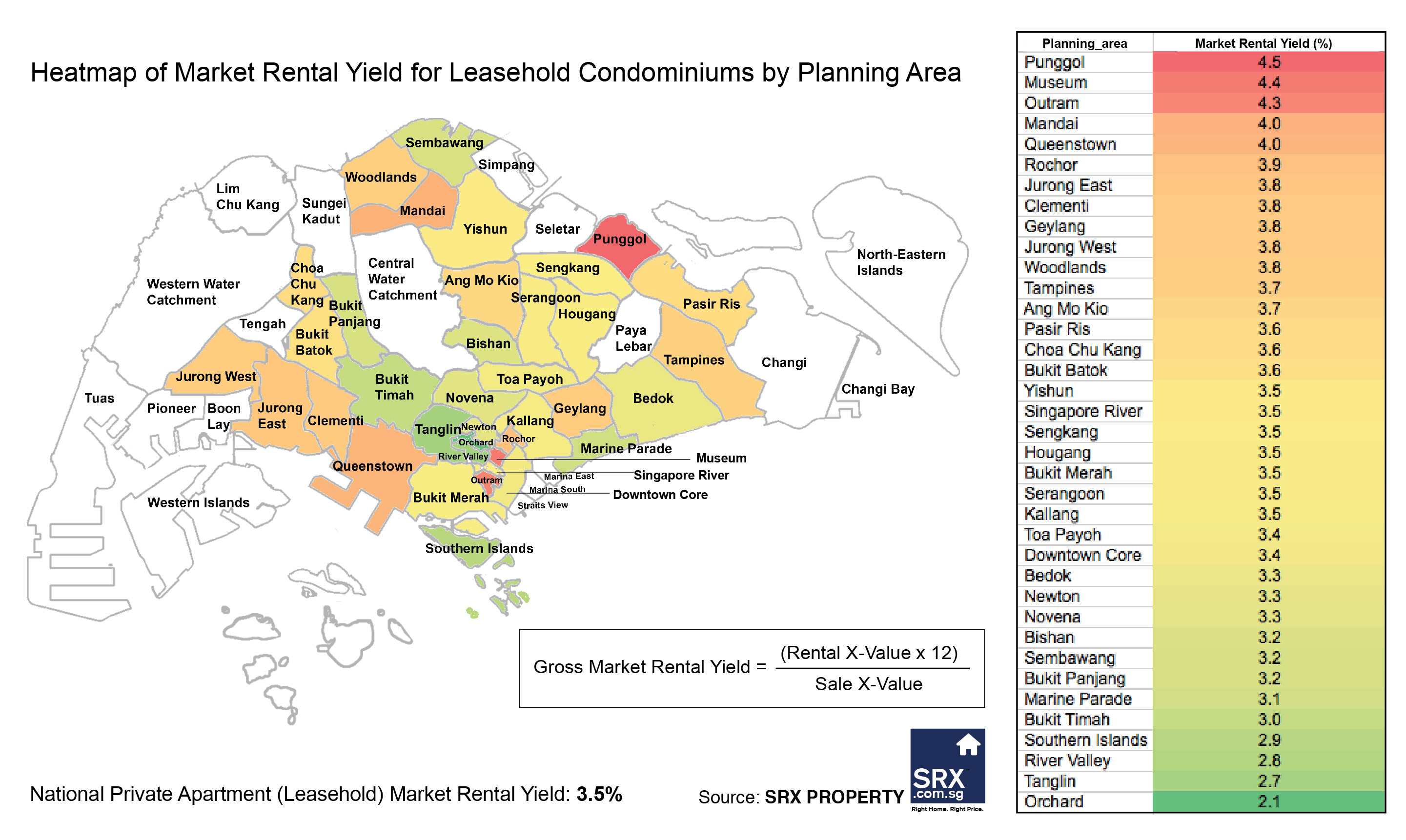

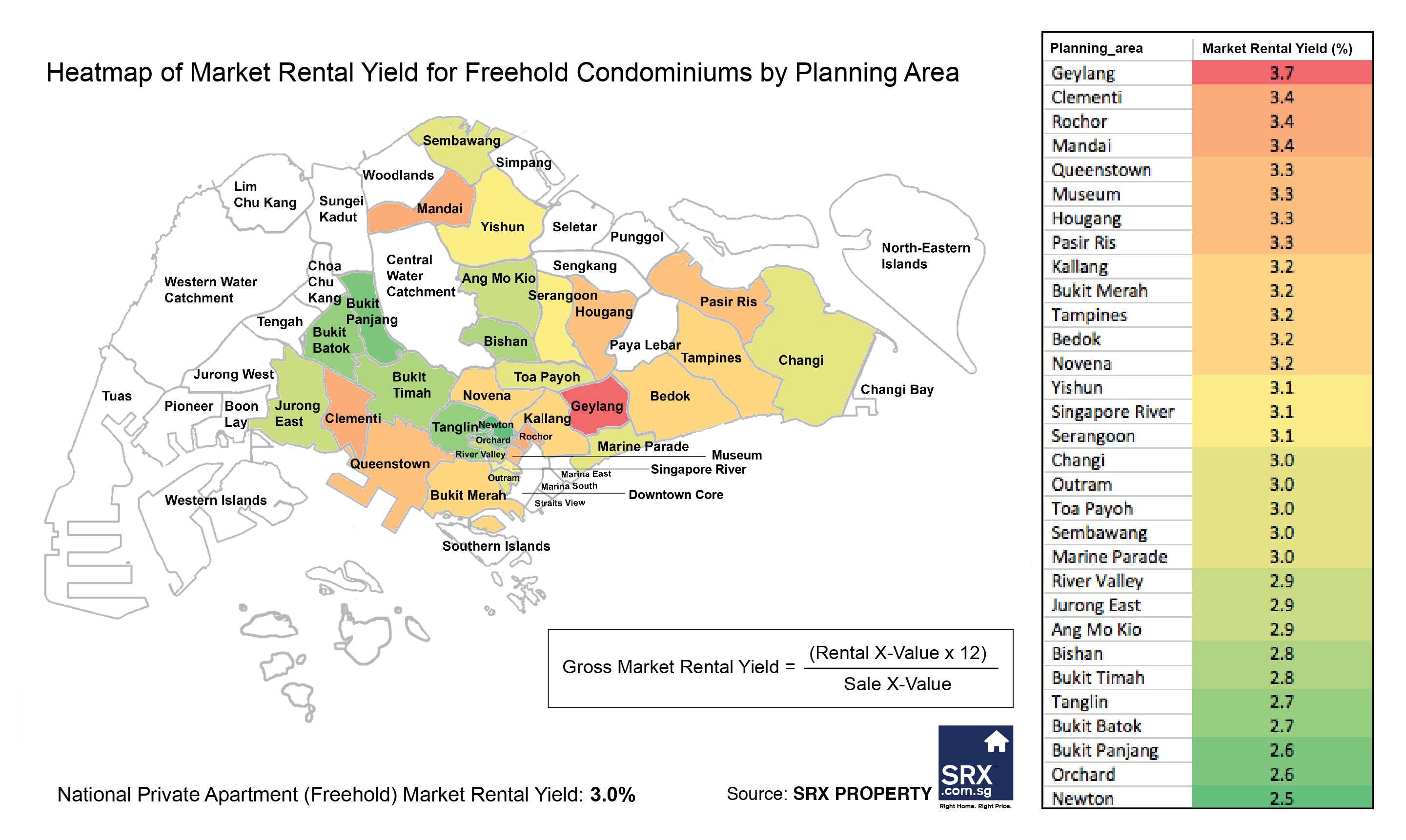

As of May 2015, the median rental yield for Leasehold private flats in Singapore is 3.5%. For Freehold properties, the median rental yield is 3.0%.

As of May 2015, the median rental yield for Leasehold private flats in Singapore is 3.5%. For Freehold properties, the median rental yield is 3.0%.

A MERGER of three real estate agencies in Singaporeis said to be underway, and three other agencies could possibly join in the union. If all six agencies come together, the new combined entity is expected to have a sales force of over 2,000 registered agents by the middle of next year, according to sources.

http://www.businesstimes.com.sg/real-estate/merger-of-real-estate-agencies-underway

http://www.businesstimes.com.sg/real-estate/merger-of-real-estate-agencies-underway

Big agencies weathering storms

Larger property agencies managed to stay afloat while smaller firms sank into the red amidst the dismal property market conditions, media reports said.

PropNex and ERA Realty, Singapore’s two biggest agencies by agent force, saw profit after tax climb 3.8 percent and 10.6 percent to $6.3 million and $11.5 million respectively, even as revenue fell for the year ended 31 December 2014.

Citing economies of scale, these property heavyweights said small and mid-sized agencies will find it hard to replicate their ability to generate activities to stimulate sales as well as support agents with value-added services.

“When you don’t have scale, your compliance and overheads will kill you,” noted ERA Realty’s chief executive Jack Chua.

Although ERA’s revenue decreased 9.9 percent to $214 million in 2014, its profit was buoyed by commercial transactions and higher-margin investment sales.

PropNex chief executive Mohamed Ismail revealed that while revenue slipped two percent to $194.8 million last year, the company streamlined its processes and upgraded its software for the back-office, allowing it to reduce headcount by about five percent. In fact, the $7.9 million profit shared among leaders and team managers was similar to that in 2013.

However, OrangeTee did not share the same fortune. The fourth largest agency in Singapore posted a net loss of more than $690,000 for the year ended 30 June 2014 after recording a net profit of $3.9 million in the previous year.

HSR International, which is ranked seventh by number of agents, also registered a net loss of $5.2 million during the fiscal year ended 31 December 2014 after posting a loss of $5.4 million in 2013.

Meanwhile, SLP’s agency business under SLP Scotia and SLP Realty saw revenue soar 66 percent to $32.3 million for the fiscal year ended 31 May 2014, due to higher commissions offered by developers. But since most of these commissions went to agents, the company’s net profit plunged 98.6 percent to $7,295 from $533,921.

With the present commission structure skewed towards higher commission payouts to sales agents, Ismail reckons that a small and medium-sized agency will find it hard to make ends meet.

“As such, only the mega or bigger agencies can make some profits.

“Looks like in Singapore, there is only room for two or three or at best four big agencies to make any meaningful business with our existing commission-sharing scheme,” he added.

http://www.propertyguru.com.sg/property-management-news/2015/6/96786/big-agencies-weathering-storms-

Romesh Navaratnarajah, Singapore Editor at PropertyGuru, edited this story. To contact him about this or other stories email [email protected]

Larger property agencies managed to stay afloat while smaller firms sank into the red amidst the dismal property market conditions, media reports said.

PropNex and ERA Realty, Singapore’s two biggest agencies by agent force, saw profit after tax climb 3.8 percent and 10.6 percent to $6.3 million and $11.5 million respectively, even as revenue fell for the year ended 31 December 2014.

Citing economies of scale, these property heavyweights said small and mid-sized agencies will find it hard to replicate their ability to generate activities to stimulate sales as well as support agents with value-added services.

“When you don’t have scale, your compliance and overheads will kill you,” noted ERA Realty’s chief executive Jack Chua.

Although ERA’s revenue decreased 9.9 percent to $214 million in 2014, its profit was buoyed by commercial transactions and higher-margin investment sales.

PropNex chief executive Mohamed Ismail revealed that while revenue slipped two percent to $194.8 million last year, the company streamlined its processes and upgraded its software for the back-office, allowing it to reduce headcount by about five percent. In fact, the $7.9 million profit shared among leaders and team managers was similar to that in 2013.

However, OrangeTee did not share the same fortune. The fourth largest agency in Singapore posted a net loss of more than $690,000 for the year ended 30 June 2014 after recording a net profit of $3.9 million in the previous year.

HSR International, which is ranked seventh by number of agents, also registered a net loss of $5.2 million during the fiscal year ended 31 December 2014 after posting a loss of $5.4 million in 2013.

Meanwhile, SLP’s agency business under SLP Scotia and SLP Realty saw revenue soar 66 percent to $32.3 million for the fiscal year ended 31 May 2014, due to higher commissions offered by developers. But since most of these commissions went to agents, the company’s net profit plunged 98.6 percent to $7,295 from $533,921.

With the present commission structure skewed towards higher commission payouts to sales agents, Ismail reckons that a small and medium-sized agency will find it hard to make ends meet.

“As such, only the mega or bigger agencies can make some profits.

“Looks like in Singapore, there is only room for two or three or at best four big agencies to make any meaningful business with our existing commission-sharing scheme,” he added.

http://www.propertyguru.com.sg/property-management-news/2015/6/96786/big-agencies-weathering-storms-

Romesh Navaratnarajah, Singapore Editor at PropertyGuru, edited this story. To contact him about this or other stories email [email protected]

A MERGER of three real estate agencies in Singaporeis said to be underway, and three other agencies could possibly join in the union. If all six agencies come together, the new combined entity is expected to have a sales force of over 2,000 registered agents by the middle of next year, according to sources.

http://www.businesstimes.com.sg/real-estate/merger-of-real-estate-agencies-underway

HDB resale volume declines

Volumes also declined slightly by about 2.2 per cent, with some 1,575 flats exchanging hands in May compared to the 1,610 sold in April

http://www.straitstimes.com/news/si...lat-prices-stay-flat-volumes-decline-20150604

Volumes also declined slightly by about 2.2 per cent, with some 1,575 flats exchanging hands in May compared to the 1,610 sold in April

http://www.straitstimes.com/news/si...lat-prices-stay-flat-volumes-decline-20150604

Petite property agent to ride 8,000km to Everest for charity

http://www.straitstimes.com/news/si...erty-agent-ride-8000km-everest-charity-201506

Good effort

http://www.straitstimes.com/news/si...erty-agent-ride-8000km-everest-charity-201506

Good effort

she not scared wait kanna rape...!

Petite property agent to ride 8,000km to Everest for charity

http://www.straitstimes.com/news/si...erty-agent-ride-8000km-everest-charity-201506

Good effort

Singapore homebuyers will drive harder bargains in an already depressed housing market as new rules that require developers to disclose discounts and other perks unmask the actual value of properties for sale.

Starting today, the Urban Redevelopment Authority will publish weekly net prices on home transactions that will take into account incentives and rebates, such as those for stamp duties, to improve transparency.

http://www.businesstimes.com.sg/rea...yers-to-seek-bargains-on-discounts-disclosure

Hefty furniture rebates became the subject of a S$181 million lawsuit in November after United Overseas Bank Ltd claimed it was a "victim of a conspiracy" and handed out larger-than-permitted housing loans after some buyers at the luxury Marina Collection on Sentosa island didn't declare perks that cut prices by as much as 34 per cent.

Starting today, the Urban Redevelopment Authority will publish weekly net prices on home transactions that will take into account incentives and rebates, such as those for stamp duties, to improve transparency.

http://www.businesstimes.com.sg/rea...yers-to-seek-bargains-on-discounts-disclosure

Hefty furniture rebates became the subject of a S$181 million lawsuit in November after United Overseas Bank Ltd claimed it was a "victim of a conspiracy" and handed out larger-than-permitted housing loans after some buyers at the luxury Marina Collection on Sentosa island didn't declare perks that cut prices by as much as 34 per cent.

Lifting of ABSD: too soon to tell

http://business.asiaone.com/news/lifting-absd-too-soon-tell

because

Rich Chinese target Singapore as high-end property market continues to recover

http://www.scmp.com/news/china/mone...se-target-singapore-skyline-high-end-property

http://business.asiaone.com/news/lifting-absd-too-soon-tell

because

Rich Chinese target Singapore as high-end property market continues to recover

http://www.scmp.com/news/china/mone...se-target-singapore-skyline-high-end-property

Similar threads

- Replies

- 1

- Views

- 670

- Replies

- 7

- Views

- 753

- Replies

- 3

- Views

- 357

- Replies

- 12

- Views

- 1K

- Replies

- 12

- Views

- 904